Advertisement

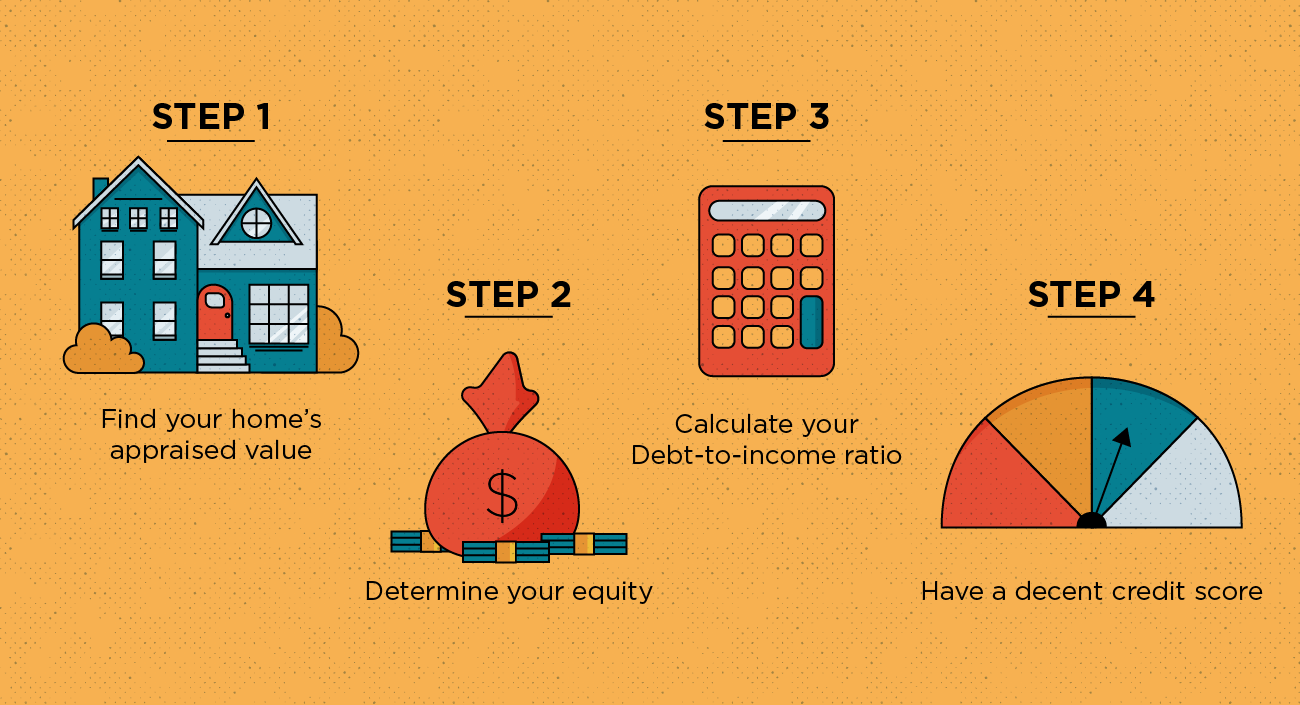

how to qualify for home equity loan – How to qualify for a home equity loan is a question that many homeowners ponder. These loans, which allow you to borrow against the equity you’ve built in your home, can be a valuable financial tool for various purposes, from home improvements to debt consolidation. However, qualifying for a home equity loan requires meeting specific criteria set by lenders, and understanding these requirements is crucial for maximizing your chances of approval.

This guide delves into the essential aspects of home equity loan eligibility, providing a comprehensive overview of the factors that lenders consider, the financial documents you’ll need, and the steps involved in the application process. By understanding these elements, you can navigate the world of home equity loans with confidence and make informed decisions about whether this type of financing aligns with your financial goals.

Understanding Home Equity Loans

A home equity loan allows you to borrow money against the equity you’ve built in your home. Equity is the difference between your home’s current market value and the outstanding mortgage balance. For example, if your home is worth $300,000 and you owe $150,000 on your mortgage, your equity is $150,000. This equity can be used as collateral to secure a loan.

Home equity loans are a popular choice for homeowners looking to access their equity for various purposes. They often come with lower interest rates than other types of loans, such as personal loans, making them a potentially attractive option.

Types of Home Equity Loans

Home equity loans come in two primary forms: Home Equity Lines of Credit (HELOCs) and fixed-rate home equity loans.

- Home Equity Lines of Credit (HELOCs): HELOCs function similarly to credit cards. They offer a revolving line of credit that you can draw from as needed, up to a predetermined limit. You only pay interest on the amount you borrow, and the interest rate is usually variable, meaning it can fluctuate over time.

- Fixed-Rate Home Equity Loans: Fixed-rate home equity loans offer a fixed interest rate for the entire loan term, which is typically between 5 and 30 years. This means your monthly payments will remain the same throughout the loan period, providing predictability and financial stability.

Uses for Home Equity Loans

Home equity loans offer flexibility and can be used for a variety of purposes, including:

- Home Improvement: This is a common use for home equity loans. The borrowed funds can be used to finance renovations, upgrades, or additions to your home, increasing its value and your enjoyment of it.

- debt consolidation: You can use a home equity loan to consolidate high-interest debt, such as credit card balances or personal loans. This can lower your monthly payments and potentially save you money on interest.

- Financing Education: Home equity loans can help fund educational expenses for yourself or your children. The borrowed funds can cover tuition, fees, books, and other educational costs.

- Medical Expenses: Home equity loans can provide financial assistance for unexpected medical expenses, such as surgeries or long-term care.

- Business Expenses: Some homeowners use home equity loans to finance business ventures or expansion. However, it’s crucial to carefully consider the risks involved before using home equity for business purposes.

Assessing Your Financial Situation: How To Qualify For Home Equity Loan

Before you dive into the home equity loan application process, it’s crucial to assess your current financial situation. Understanding your income, debt, and assets will help you determine if a home equity loan is a good fit for your financial goals and whether you can comfortably handle the added financial obligation.

Essential Financial Documents, How to qualify for home equity loan

To ensure a smooth application process, gather the following essential financial documents:

| Document | Description |

|---|---|

| Recent Pay Stubs | Demonstrate your current income and employment status. |

| Tax Returns (2-3 Years) | Provide a comprehensive picture of your income and expenses. |

| Bank Statements (2-3 Months) | Show your cash flow and transaction history. |

| Credit Report | Displays your credit history and score, which lenders use to assess your creditworthiness. |

| Mortgage Statement | Provides details about your current mortgage loan, including the outstanding balance and interest rate. |

Evaluating Your Financial Standing

Here’s a checklist to evaluate your current financial standing:

- Income: Review your income sources and assess your monthly income after taxes and deductions. This includes your salary, wages, bonuses, and any other regular income streams.

- Debt: Analyze your outstanding debt obligations, including credit card balances, student loans, personal loans, and other liabilities. This includes the minimum monthly payments and interest rates for each debt.

- Assets: Make an inventory of your assets, including your home’s equity, savings accounts, investments, and other valuable possessions.

Calculating Your Debt-to-Income Ratio

Understanding your debt-to-income ratio (DTI) is crucial for assessing your financial health and loan eligibility. DTI represents the percentage of your monthly gross income that goes towards debt payments.

DTI = (Total Monthly Debt Payments) / (Gross Monthly Income)

For example, if your total monthly debt payments are $1,500 and your gross monthly income is $5,000, your DTI would be 30%.

Lenders typically prefer a DTI below 43% for home equity loans. A lower DTI indicates that you have more disposable income to manage your existing debt obligations and handle the added monthly payments of a home equity loan.

Exploring Loan Options and Rates

Once you’ve determined your eligibility for a home equity loan, the next step is to explore the various loan options available and compare their terms and rates. This involves understanding the different types of loans, their associated costs, and how they might affect your overall financial situation.

Comparison of Interest Rates and Terms

When comparing home equity loans, it’s crucial to consider the interest rates and loan terms offered by different lenders. These factors significantly impact the overall cost of borrowing.

- Interest Rates: Interest rates on home equity loans can vary depending on several factors, including your credit score, loan-to-value ratio (LTV), and the current market conditions. Generally, borrowers with higher credit scores and lower LTVs qualify for lower interest rates.

- Loan Terms: Loan terms refer to the duration of the loan, typically expressed in years. Longer loan terms often result in lower monthly payments but lead to higher overall interest costs. Conversely, shorter loan terms involve higher monthly payments but result in lower overall interest costs.

Fixed-Rate vs. Variable-Rate Loans

home equity loans are typically offered with either fixed or variable interest rates. Understanding the advantages and disadvantages of each type is crucial for making an informed decision.

- Fixed-Rate Loans: With a fixed-rate loan, the interest rate remains constant throughout the loan term, providing predictable monthly payments. This offers stability and protection against rising interest rates. However, fixed-rate loans may have higher initial interest rates compared to variable-rate loans.

- Variable-Rate Loans: Variable-rate loans have interest rates that fluctuate based on a benchmark index, such as the prime rate. This means your monthly payments can vary over time. Variable-rate loans often start with lower interest rates than fixed-rate loans, but they carry the risk of higher payments if interest rates rise.

Potential Fees Associated with Home Equity Loans

Home equity loans often come with various fees that can add to the overall cost of borrowing. It’s important to understand these fees and their impact on your finances.

- Origination Fee: This fee is charged by the lender for processing your loan application and can range from 1% to 3% of the loan amount.

- Appraisal Fee: Lenders require an appraisal to determine the current market value of your home, which is necessary to assess your loan-to-value ratio. Appraisal fees can vary depending on the property’s location and size.

- Closing Costs: These are various expenses associated with finalizing the loan, including title insurance, recording fees, and attorney fees. Closing costs can vary depending on the lender and the location of the property.

- Prepayment Penalty: Some lenders may impose a prepayment penalty if you pay off the loan early. This penalty can reduce the financial benefits of paying off the loan sooner.

Application and Approval Process

Applying for a home equity loan involves several steps, including gathering essential documentation and submitting a formal application. Once submitted, the lender will review your application and assess your creditworthiness, income, and property value. The approval process typically takes several weeks, but the timeline can vary depending on several factors. Finally, you’ll need to attend a closing meeting to finalize the loan terms and receive the funds.

Gathering Documentation

The first step in applying for a home equity loan is gathering the necessary documentation. This will include:

- Proof of Income: Lenders will require documentation that verifies your income, such as recent pay stubs, tax returns, or bank statements. This is essential to demonstrate your ability to repay the loan.

- Credit Report: Lenders will review your credit history to assess your creditworthiness. A good credit score is essential for securing a favorable loan interest rate. You can obtain a free copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

- Home Appraisal: The lender will typically require a professional appraisal to determine the current market value of your home. This helps them assess the equity you have in your home and the potential risk associated with the loan.

- Property Tax Information: You will need to provide details about your property taxes, such as the current tax rate and any outstanding payments.

- Home Insurance Policy: Lenders require proof of adequate home insurance coverage, which protects them in case of damage to your property.

Submitting the Application

Once you have gathered all the necessary documentation, you can submit your home equity loan application. The application process may vary depending on the lender, but it typically involves completing an online form or meeting with a loan officer.

Loan Approval Process

After submitting your application, the lender will review your financial information and assess your creditworthiness. The approval process typically involves:

- Credit Check: Lenders will pull your credit report to assess your credit score and history. A higher credit score generally leads to better loan terms.

- Income Verification: The lender will verify your income to ensure you have the ability to repay the loan. They may require documentation such as pay stubs, tax returns, or bank statements.

- Property Appraisal: The lender will order an appraisal to determine the current market value of your home. This helps them assess the equity you have in your home and the risk associated with the loan.

- Loan Underwriting: The lender will review your application and all supporting documentation to determine if you qualify for the loan. This process typically takes several weeks.

Factors Affecting Loan Approval Timeline

Several factors can influence the timeline for loan approval, including:

- Loan Amount: Larger loan amounts may require more time for underwriting and processing.

- Credit Score: Borrowers with higher credit scores may receive approval faster.

- Loan Complexity: Loans with more complex terms or conditions may take longer to process.

- Lender’s Processing Time: Each lender has its own processing procedures and timelines. Some lenders may be faster than others.

Closing on a Home Equity Loan

Once your loan is approved, you will need to attend a closing meeting to finalize the loan terms. This typically involves:

- Reviewing Loan Documents: You will need to carefully review the loan documents, including the loan agreement, promissory note, and closing disclosure.

- Signing Documents: You will be required to sign all the necessary loan documents at the closing meeting.

- Disbursement of Funds: Once you have signed all the documents, the lender will disburse the loan funds to you.