can you pay off a home equity loan early sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with detailed analytical writing style and brimming with originality from the outset. A home equity loan, often referred to as a second mortgage, allows homeowners to borrow against the equity they've built in their homes. While these loans can provide a financial lifeline for various needs, from home renovations to debt consolidation, the question of early repayment often arises. This exploration delves into the intricacies of early repayment, analyzing its potential benefits and drawbacks, and providing practical strategies for those seeking to accelerate their debt reduction journey.

Understanding the fundamentals of home equity loans is paramount before embarking on the journey of early repayment. Homeowners with substantial equity in their homes can leverage this asset to secure a loan, often at lower interest rates than other forms of borrowing. The funds from a home equity loan can be used for various purposes, including home improvements, debt consolidation, medical expenses, or even education costs. However, it's crucial to weigh the advantages against the disadvantages before taking out a home equity loan. The primary advantage lies in the potential for lower interest rates, which can significantly reduce borrowing costs. Furthermore, the flexibility of using the funds for diverse purposes adds to the appeal. However, potential drawbacks include the risk of losing your home if you default on the loan, the possibility of higher interest rates compared to other loan options, and the potential impact on your credit score if you don't make timely payments. Before applying for a home equity loan, it's essential to assess your financial situation, consider the loan terms, and evaluate the risks and benefits carefully.

Understanding Home Equity Loans: Can You Pay Off A Home Equity Loan Early

A home equity loan, also known as a second mortgage, is a loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of your home and the amount you still owe on your mortgage. home equity loans can be a useful tool for homeowners looking to access funds for various purposes.

A home equity loan, also known as a second mortgage, is a loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of your home and the amount you still owe on your mortgage. home equity loans can be a useful tool for homeowners looking to access funds for various purposes.

How Home Equity Loans Work, Can you pay off a home equity loan early

home equity loans are typically fixed-rate loans with a set repayment term, usually between 5 and 30 years. The interest rate on a home equity loan is generally lower than other types of loans, such as personal loans or credit cards, because your home serves as collateral. If you default on the loan, the lender can foreclose on your home.Uses of Home Equity Loans

Homeowners use home equity loans for a variety of purposes, including:- Home improvements: Renovations, additions, or repairs.

- debt consolidation: Combining high-interest debt into a lower-interest loan.

- Medical expenses: Covering unexpected medical bills.

- Education expenses: Paying for college tuition or other education costs.

- Major purchases: Funding a new car, vacation, or other significant expenses.

Advantages of Home Equity Loans

Home equity loans offer several advantages:- Lower interest rates: Compared to other types of loans, home equity loans often have lower interest rates.

- Fixed monthly payments: You'll know exactly how much you'll pay each month, making budgeting easier.

- Tax-deductible interest: In some cases, the interest you pay on a home equity loan may be tax-deductible.

- Large loan amounts: Home equity loans can provide access to significant funds, depending on your equity.

Disadvantages of Home Equity Loans

While home equity loans can be beneficial, they also come with potential drawbacks:- Risk of foreclosure: If you default on the loan, you could lose your home.

- Higher interest rates than a first mortgage: Even though home equity loans have lower interest rates than some other loan types, they are generally higher than the interest rate on your first mortgage.

- Potential for overspending: Easy access to funds can lead to overspending and debt accumulation.

- Closing costs: You'll typically have to pay closing costs when you take out a home equity loan.

Key Factors to Consider Before Applying for a Home Equity Loan

Before applying for a home equity loan, it's essential to carefully consider the following factors:- Your equity: Ensure you have enough equity in your home to qualify for the loan amount you need.

- Your credit score: A higher credit score will result in lower interest rates.

- Your debt-to-income ratio: Lenders look at your debt-to-income ratio to assess your ability to repay the loan.

- The loan terms: Carefully review the interest rate, loan term, and any associated fees.

- Your financial goals: Determine if a home equity loan is the right financial tool to achieve your goals.

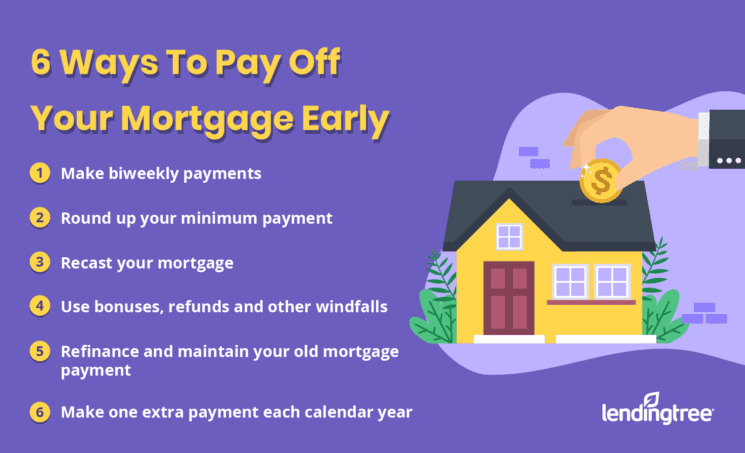

Strategies for Early Repayment

Paying off your home equity loan early can save you a significant amount of interest over the life of the loan. While it may seem challenging, there are several strategies you can employ to accelerate your repayment.

Paying off your home equity loan early can save you a significant amount of interest over the life of the loan. While it may seem challenging, there are several strategies you can employ to accelerate your repayment.

Developing a Repayment Plan

Creating a comprehensive repayment plan is crucial for achieving your goal of early loan payoff. This plan should Artikel your financial goals, strategies, and a realistic timeline for achieving them.- Determine Your Loan Details: Begin by understanding the key aspects of your loan, such as the principal amount, interest rate, and remaining loan term. This information will help you calculate your monthly payments and project your total interest costs.

- Set a Clear Goal: Establish a specific target for early repayment, such as paying off the loan in half the original term or reaching a certain percentage of loan reduction within a set timeframe. Having a clear goal will motivate you and provide a benchmark for your progress.

- Assess Your Budget: Carefully analyze your income and expenses to determine how much extra money you can allocate towards your home equity loan repayment. This involves identifying areas where you can reduce spending and free up additional funds.

- Create a Repayment Schedule: Based on your budget and loan details, develop a detailed repayment schedule. This schedule should Artikel the amount you will pay each month, the frequency of payments, and any additional lump sum payments you plan to make.

Maximizing Repayment Efforts

Once you have a plan in place, you can implement various strategies to maximize your repayment efforts. These strategies focus on increasing your payment amount, reducing your loan term, and minimizing interest costs.- Increase Your Monthly Payments: Even small increases in your monthly payments can significantly impact your loan payoff timeline. Consider making an additional payment each month, or round up your payment to the nearest hundred dollars.

- Make Lump Sum Payments: If you receive a bonus, tax refund, or inherit money, consider using a portion of it to make a lump sum payment towards your home equity loan. This will reduce your principal balance and shorten your loan term.

- Refinance to a Lower Interest Rate: If interest rates have declined since you took out your home equity loan, consider refinancing to a lower interest rate. This will reduce your monthly payments and free up more money for additional principal payments.

- Negotiate with Your Lender: If you are facing financial hardship, contact your lender to discuss potential repayment options, such as a temporary forbearance or a loan modification.

Examples of Actionable Steps

To illustrate how these strategies can be applied in practice, here are some specific examples of actionable steps you can take:- Example 1: Increasing Monthly Payments: If your monthly payment is $500, consider increasing it to $550 or $600. This small increase will significantly impact your loan payoff timeline over the long term.

- Example 2: Making Lump Sum Payments: If you receive a $5,000 tax refund, consider using $2,500 to make a lump sum payment towards your home equity loan. This will reduce your principal balance and accelerate your repayment.

- Example 3: Refinancing to a Lower Interest Rate: If you have a 6% interest rate on your home equity loan and current rates are around 4%, consider refinancing to a lower interest rate. This will save you money on interest payments and free up more cash for additional principal payments.

Considerations Before Early Repayment

While the prospect of paying off your home equity loan early might seem appealing, it's crucial to carefully consider all aspects before making a decision. Early repayment can have both positive and negative implications, and it's essential to weigh them thoroughly to ensure it aligns with your overall financial goals.

While the prospect of paying off your home equity loan early might seem appealing, it's crucial to carefully consider all aspects before making a decision. Early repayment can have both positive and negative implications, and it's essential to weigh them thoroughly to ensure it aligns with your overall financial goals.

Potential Risks Associated with Early Repayment

Early repayment of a home equity loan can come with potential drawbacks, which you should carefully evaluate before proceeding.- Penalties for Early Repayment: Some home equity loan agreements include prepayment penalties, which can significantly impact your savings. These penalties are designed to protect lenders from losing interest income due to early repayment. Carefully review your loan agreement to determine if such penalties exist and how they are calculated. For example, you might face a penalty equal to a percentage of the outstanding loan balance or a fixed amount.

- Missed Investment Opportunities: Paying off your home equity loan early means you might be forgoing potential investment opportunities that could yield higher returns. If you have other investments that are generating a higher return than the interest rate on your home equity loan, it might be more beneficial to keep the loan and invest the extra money elsewhere. For instance, investing in a high-yield savings account or the stock market could potentially provide a greater return than paying off the loan early.

Reviewing Your Overall Financial Situation

Before deciding to pay off your home equity loan early, it's crucial to conduct a comprehensive review of your overall financial situation. This includes:- Assessing Your Budget: Analyze your income and expenses to determine if you can comfortably afford to make larger loan payments or allocate additional funds towards early repayment. Consider your essential expenses, such as housing, utilities, groceries, and transportation, and ensure you have enough remaining to cover unexpected costs or emergencies.

- Evaluating Your Debt: Examine your overall debt load, including credit card debt, student loans, and other personal loans. Prioritize paying down high-interest debt first, as it can significantly impact your financial well-being. If you have high-interest debt, it might be more beneficial to focus on reducing that before paying off your home equity loan.

- Analyzing Your Savings and Emergency Fund: Ensure you have a sufficient emergency fund to cover unexpected expenses. It's generally recommended to have 3-6 months' worth of living expenses saved in an emergency fund. If your emergency fund is depleted, it's crucial to replenish it before making significant debt payments.

Determining if Early Repayment is the Right Choice

Once you've reviewed your financial situation, consider the following factors to determine if early repayment is the right choice for you:- Interest Rate on Your Home Equity Loan: If the interest rate on your home equity loan is relatively low, it might be more beneficial to invest the extra money elsewhere, especially if you have other debts with higher interest rates. For example, if your home equity loan has an interest rate of 5% and you have credit card debt with an interest rate of 20%, it's generally more financially advantageous to focus on paying down the credit card debt first.

- Your Financial Goals: Consider your long-term financial goals. If you are saving for retirement, a down payment on a new home, or other significant expenses, it might be more beneficial to keep the loan and invest the extra money towards those goals.

- Your Risk Tolerance: Evaluate your risk tolerance. If you are comfortable with taking on more risk, you might be willing to invest the extra money in the stock market or other higher-yielding investments. If you are risk-averse, you might prefer to pay off the loan and eliminate the debt.