Fees for home equity loans are an integral part of the borrowing process, influencing the overall cost of using your home's equity for financing. This guide provides a comprehensive exploration of these fees, encompassing their types, calculation methods, and factors influencing their magnitude. By understanding the intricacies of these fees, borrowers can make informed decisions, negotiate favorable terms, and ultimately minimize the financial burden associated with home equity loans.

The article delves into the common types of fees associated with home equity loans, including origination fees, appraisal fees, closing costs, and more. It examines how interest rates, loan terms, credit scores, and loan-to-value ratios impact these fees. Furthermore, it explores strategies for minimizing fees, such as negotiating with lenders, shopping around for the best rates, and understanding loan terms and requirements. Finally, the article compares home equity loans to alternative financing options, highlighting their respective advantages and disadvantages in terms of fees and overall cost.

Fees Associated with Home Equity Loans

fees for home equity loan" title="Borrowing cost true infographic term money" />

Home equity loans, also known as second mortgages, allow homeowners to borrow against the equity they've built up in their homes. While these loans can provide access to funds for various purposes, it's crucial to understand the associated fees, as they can significantly impact the overall cost of borrowing.

fees for home equity loan" title="Borrowing cost true infographic term money" />

Home equity loans, also known as second mortgages, allow homeowners to borrow against the equity they've built up in their homes. While these loans can provide access to funds for various purposes, it's crucial to understand the associated fees, as they can significantly impact the overall cost of borrowing.

Types of Fees Associated with Home Equity Loans

The fees associated with home equity loans vary depending on the lender and the specific loan terms. However, some common types of fees include:- Origination Fee: This fee is charged by the lender to cover the administrative costs of processing the loan. It is typically a percentage of the loan amount, ranging from 0.5% to 2%.

- Appraisal Fee: An appraisal is conducted to determine the current market value of the property, ensuring that the loan amount does not exceed the home's worth. The cost of this appraisal, usually ranging from $300 to $500, is typically paid by the borrower.

- Credit Report Fee: Lenders need to check your credit history to assess your creditworthiness. This fee, usually around $30 to $50, is charged to cover the cost of obtaining your credit report.

- Closing Costs: These are miscellaneous expenses incurred during the loan closing process. They can include fees for title insurance, recording fees, and other legal and administrative charges. Closing costs can vary significantly depending on the location and the complexity of the loan.

- Prepayment Penalty: Some lenders may charge a penalty if you pay off the loan early. This penalty is usually a percentage of the outstanding loan balance.

Calculating the Impact of Fees

Fees can significantly impact the overall cost of a home equity loan. For instance, a $50,000 home equity loan with a 2% origination fee would incur a fee of $1,000. This fee is added to the loan amount, increasing the total borrowed amount to $51,000.The impact of fees is amplified over the loan term, as interest is calculated on the total borrowed amount, including the fees.Furthermore, additional fees like appraisal and credit report fees contribute to the overall cost. It's essential to consider these fees when comparing different loan offers and to factor them into your budgeting calculations.

Factors Influencing Home Equity Loan Fees

Home equity loan fees are influenced by a variety of factors, including interest rates, loan terms, credit score, and the loan-to-value (LTV) ratio. Understanding these factors can help borrowers make informed decisions about their home equity loans.

Home equity loan fees are influenced by a variety of factors, including interest rates, loan terms, credit score, and the loan-to-value (LTV) ratio. Understanding these factors can help borrowers make informed decisions about their home equity loans.

Interest Rates

Interest rates are a significant factor that impacts home equity loan fees. Higher interest rates lead to higher borrowing costs and increased fees. Interest rates are influenced by factors such as the prevailing market conditions, the borrower's creditworthiness, and the loan term.For example, if the prevailing interest rate for home equity loans is 6%, a borrower with a good credit score might receive a lower rate, say 5.5%, resulting in lower fees compared to a borrower with a lower credit score who might receive a rate of 7%.

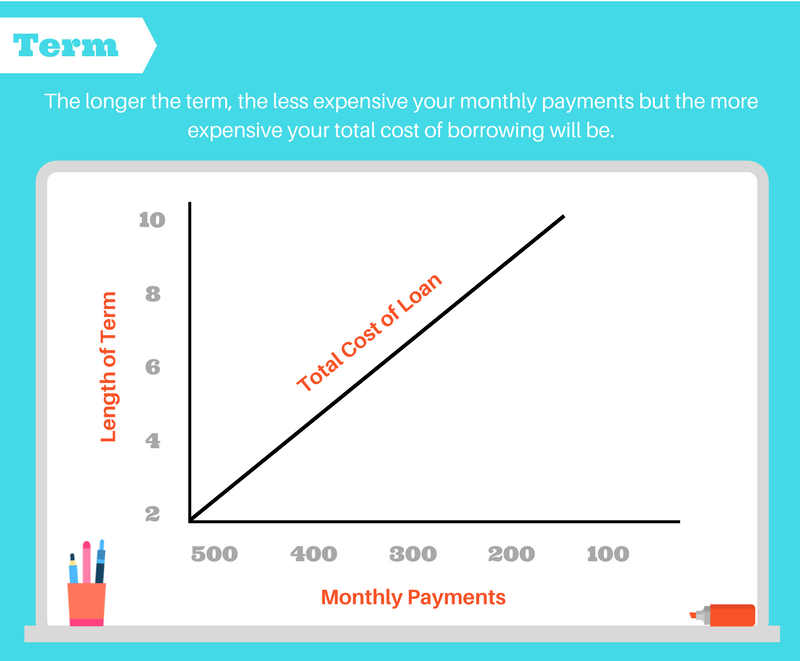

Loan Terms

Loan terms, including the loan amount and repayment period, also play a crucial role in determining home equity loan fees. A larger loan amount typically results in higher fees, while a longer repayment period can lead to lower monthly payments but higher overall interest charges.For instance, a borrower with a $50,000 loan over 15 years will likely pay lower monthly payments but higher total interest compared to a borrower with a $25,000 loan over 10 years.

Credit Score and Loan-to-Value Ratio, Fees for home equity loan

A borrower's credit score and the loan-to-value (LTV) ratio are crucial factors that influence home equity loan fees. A higher credit score generally results in lower interest rates and fees, while a lower credit score can lead to higher rates and fees. The LTV ratio, which represents the percentage of the home's value that is being borrowed against, also affects fees. A lower LTV ratio typically results in lower fees.For example, a borrower with a credit score of 750 and an LTV ratio of 60% is likely to receive a lower interest rate and fees compared to a borrower with a credit score of 600 and an LTV ratio of 80%.

Comparing Fees Across Lenders

Understanding the fees associated with home equity loans is crucial, as they can significantly impact the overall cost of borrowing. Comparing fees across different lenders is essential to ensure you're getting the best possible deal.

Comparing Home Equity Loan Fees

The following table compares the fees charged by different lenders for home equity loans. It's important to note that these fees can vary depending on factors such as your credit score, loan amount, and the lender's specific policies.

| Lender | Interest Rate | Origination Fee | Appraisal Fee | Other Fees |

|---|---|---|---|---|

| Lender A | 5.50% | 1% of loan amount | $500 | $100 for document preparation |

| Lender B | 5.75% | 0.75% of loan amount | $450 | $75 for credit report |

| Lender C | 6.00% | 0.50% of loan amount | $400 | None |

Alternatives to Home Equity Loans: Fees For Home Equity Loan

While home equity loans can be a viable option for financing various needs, it's essential to explore alternative financing options to determine the most suitable solution based on your individual circumstances. Comparing home equity loans with other financing avenues, such as personal loans and cash-out refinancing, can help you make an informed decision.

While home equity loans can be a viable option for financing various needs, it's essential to explore alternative financing options to determine the most suitable solution based on your individual circumstances. Comparing home equity loans with other financing avenues, such as personal loans and cash-out refinancing, can help you make an informed decision.

Comparing Home Equity Loans with Other Financing Options

Understanding the nuances of different financing options is crucial for making a well-informed decision. This section delves into the key aspects of home equity loans, personal loans, and cash-out refinancing, highlighting their advantages and disadvantages to assist you in selecting the most suitable option for your financial needs.Home Equity Loans

Home equity loans allow homeowners to borrow against the equity they've accumulated in their homes. This equity represents the difference between the current market value of your home and the outstanding mortgage balance. Home equity loans typically offer fixed interest rates, predictable monthly payments, and longer repayment terms, making them a relatively stable financing option.Pros

- Lower Interest Rates: Compared to personal loans, home equity loans often come with lower interest rates due to the use of your home as collateral.

- Fixed Interest Rates: Fixed interest rates provide stability and predictability, ensuring your monthly payments remain consistent throughout the loan term.

- Longer Repayment Terms: Extended repayment terms allow for lower monthly payments, making the loan more manageable.

- Tax Deductibility: Interest paid on home equity loans used for home improvements may be tax-deductible, potentially saving you money on your taxes.

Cons

- Risk of Foreclosure: As your home serves as collateral, defaulting on payments could lead to foreclosure, resulting in the loss of your property.

- Higher Closing Costs: Home equity loans typically involve higher closing costs compared to personal loans, including origination fees, appraisal fees, and title insurance.

- Impact on Home Equity: Borrowing against your home equity reduces the amount of equity you have built up, potentially limiting your future borrowing capacity.

- Potential for Negative Equity: If the value of your home declines, you could end up with negative equity, where you owe more than your home is worth.