home owner loan calculator - The Homeowner Loan Calculator is a powerful tool that empowers you to navigate the complexities of home financing with confidence. Whether you're considering refinancing your existing mortgage, tapping into your home's equity, or simply exploring different loan options, a homeowner loan calculator provides the insights you need to make informed decisions.

This calculator simplifies the process of evaluating loan terms, allowing you to compare different scenarios and understand the true cost of borrowing. By inputting key factors such as loan amount, interest rate, and loan term, you can quickly estimate your monthly payments, total interest paid, and the overall cost of the loan.

Understanding Homeowner Loans

Homeowner loans are financial products designed specifically for individuals who own their homes. These loans offer a way to access funds for various purposes, such as home improvements, debt consolidation, or even funding for personal expenses.Types of Homeowner Loans

There are several types of homeowner loans, each with its unique features and benefits. Understanding the differences between these loans is crucial to choosing the right option for your specific needs.- Mortgage Refinancing: This involves replacing your existing mortgage with a new one, often with a lower interest rate or a shorter loan term. This can help you save money on interest payments and pay off your mortgage faster. For example, if you secured a mortgage with a higher interest rate during a period of rising rates and rates have since fallen, refinancing could be a beneficial option.

- Home Equity Loans: These are lump-sum loans secured against the equity you've built in your home. Equity refers to the difference between the current market value of your home and the outstanding mortgage balance. You receive a fixed amount of money upfront and repay it over a set period with fixed interest rates. This type of loan is typically used for major expenses like home renovations or debt consolidation.

- Home Equity Lines of Credit (HELOCs): These are revolving lines of credit secured against your home's equity. Similar to credit cards, you can borrow money up to a pre-determined credit limit and pay it back as needed. HELOCs offer flexible borrowing options, allowing you to access funds as needed, making them suitable for unexpected expenses or ongoing projects.

Using a Homeowner Loan Calculator

A homeowner loan calculator is a valuable tool for anyone considering taking out a mortgage. It allows you to estimate your monthly payments, total interest paid, and total cost of the loan based on various loan parameters. Understanding how to use a homeowner loan calculator empowers you to make informed financial decisions.

A homeowner loan calculator is a valuable tool for anyone considering taking out a mortgage. It allows you to estimate your monthly payments, total interest paid, and total cost of the loan based on various loan parameters. Understanding how to use a homeowner loan calculator empowers you to make informed financial decisions.

Understanding Key Input Parameters

The accuracy of the results provided by a homeowner loan calculator depends on the accuracy of the input parameters. These parameters represent the core elements of your loan.- Loan Amount: This is the principal amount you borrow from the lender. The loan amount is usually the purchase price of the property minus any down payment you make.

- Interest Rate: The interest rate represents the cost of borrowing money. It is expressed as an annual percentage rate (APR). The interest rate is determined by factors such as the lender's risk assessment, market conditions, and your credit score.

- Loan Term: The loan term is the length of time you have to repay the loan. It is typically expressed in years. Common loan terms range from 15 to 30 years.

Calculating Monthly Payments

A homeowner loan calculator uses a mathematical formula called the amortization formula to determine your monthly payment. The formula considers the loan amount, interest rate, and loan term to calculate the amount you will pay each month.The amortization formula is: Monthly Payment = (Loan Amount * Interest Rate) / (1 - (1 + Interest Rate)^(-Loan Term))For example, if you borrow $200,000 at an interest rate of 4% for a 30-year loan term, the calculator will use the amortization formula to determine your monthly payment.

Calculating Total Interest Paid

The total interest paid is the total amount of interest you will pay over the life of the loan. The homeowner loan calculator calculates this by multiplying your monthly payment by the number of payments you will make over the loan term and subtracting the original loan amount.Total Interest Paid = (Monthly Payment * Number of Payments) - Loan AmountFor example, if your monthly payment is $1,000 and you make 360 payments (30 years * 12 months per year), the total interest paid would be $160,000.

Calculating Total Cost of the Loan

The total cost of the loan represents the total amount you will pay back to the lender, including both the principal amount and the interest paid. The homeowner loan calculator determines this by adding the total interest paid to the original loan amount.Total Cost of the Loan = Loan Amount + Total Interest PaidIn our previous example, the total cost of the loan would be $360,000 ($200,000 + $160,000).

Factors Influencing Loan Calculations

Understanding the factors that influence homeowner loan calculations is crucial for making informed decisions about your mortgage. These factors play a significant role in determining your monthly payments, overall loan cost, and eligibility for a loan.Interest Rates

Interest rates are a fundamental component of loan calculations. They represent the cost of borrowing money. A higher interest rate will result in larger monthly payments and a higher total loan cost. Conversely, a lower interest rate will lead to smaller monthly payments and a lower total loan cost.The impact of interest rates on loan calculations can be substantial. For example, a 1% difference in interest rates over a 30-year mortgage can result in thousands of dollars in additional interest paid over the life of the loan.

Loan Term

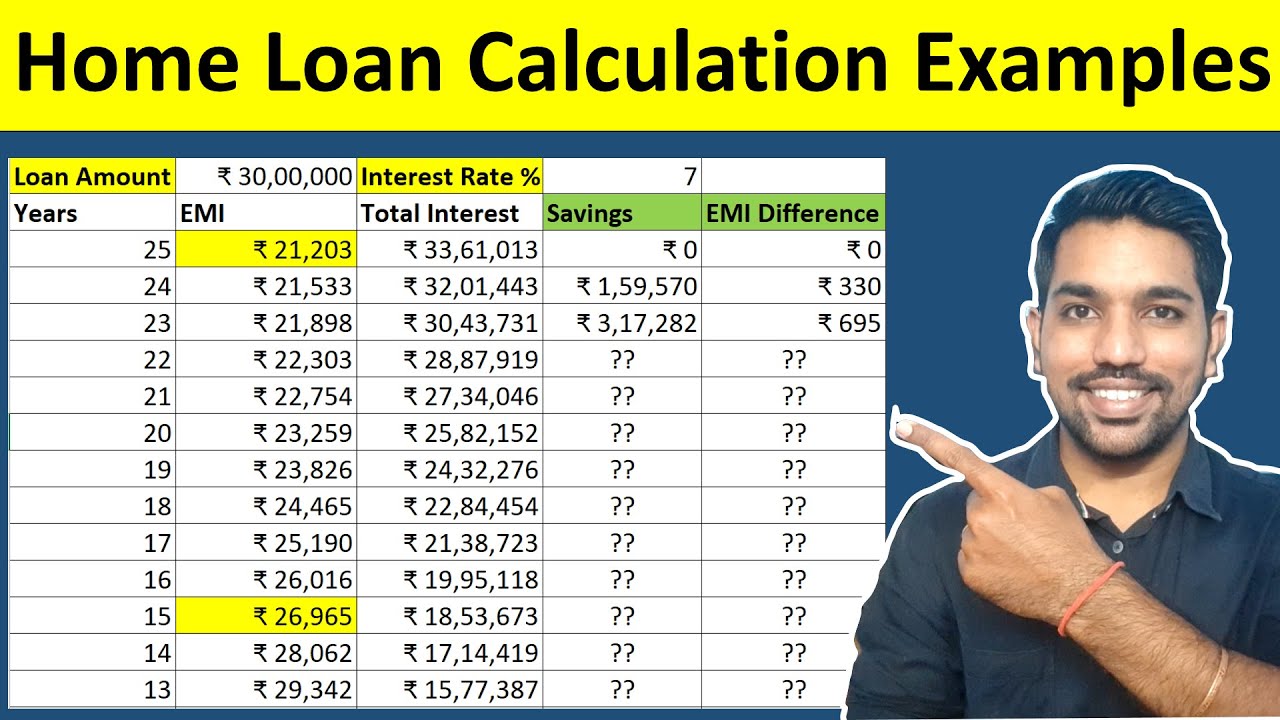

The loan term, which is the length of time you have to repay the loan, significantly affects your monthly payments. A shorter loan term will lead to higher monthly payments but a lower total loan cost due to less accumulated interest. A longer loan term will result in lower monthly payments but a higher total loan cost.For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage, but you will pay significantly less interest over the life of the loan.

Property Value and Equity

The value of the property and your equity in it are crucial factors for loan eligibility and terms. Lenders typically require a certain amount of equity in the property to approve a loan. Equity is the difference between the current market value of the property and the outstanding loan balance.Higher equity can lead to more favorable loan terms, such as a lower interest rate or a larger loan amount.

Loan Fees and Closing Costs

Loan fees and closing costs are expenses associated with obtaining a mortgage. These fees can include origination fees, appraisal fees, and title insurance. They can significantly impact the overall cost of the loan.It's essential to factor in these fees when comparing different loan options, as they can add thousands of dollars to the total cost of the loan.

Benefits of Using a Homeowner Loan Calculator

A homeowner loan calculator is a valuable tool that can empower homeowners to make informed decisions regarding their mortgage financing. By providing a clear and comprehensive overview of various loan options and their associated costs, the calculator helps homeowners navigate the complexities of mortgage financing effectively.

A homeowner loan calculator is a valuable tool that can empower homeowners to make informed decisions regarding their mortgage financing. By providing a clear and comprehensive overview of various loan options and their associated costs, the calculator helps homeowners navigate the complexities of mortgage financing effectively.

Comparing Loan Options, Home owner loan calculator

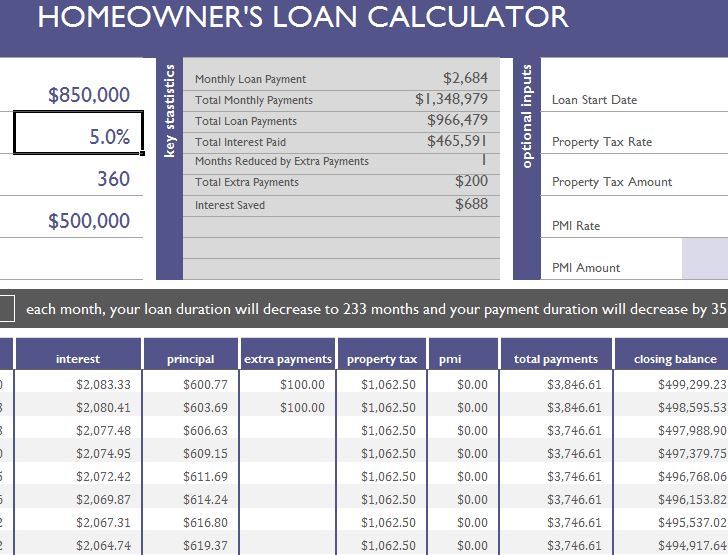

A homeowner loan calculator enables homeowners to compare different loan options side-by-side. By inputting variables such as loan amount, interest rate, and loan term, homeowners can generate estimates of monthly payments, total interest paid, and overall loan cost for various loan scenarios. This comparative analysis allows homeowners to identify the most suitable loan option based on their individual financial circumstances and goals. For example, a homeowner can compare a 15-year fixed-rate mortgage with a 30-year fixed-rate mortgage to see the impact of different loan terms on their monthly payments and total interest paid.Estimating Monthly Payments and Overall Loan Costs

One of the primary benefits of using a homeowner loan calculator is the ability to estimate monthly payments and overall loan costs. By inputting relevant loan details, homeowners can obtain a precise estimate of their monthly mortgage payments, including principal and interest, as well as property taxes and insurance. This information is crucial for budgeting purposes and helps homeowners determine if they can afford a particular loan option. The calculator also estimates the total interest paid over the life of the loan, providing homeowners with a clear understanding of the overall cost of borrowing.Making Informed Decisions About Loan Terms and Conditions

A homeowner loan calculator empowers homeowners to make informed decisions about loan terms and conditions. By experimenting with different interest rates, loan terms, and down payment amounts, homeowners can see how these factors affect their monthly payments, total interest paid, and overall loan cost. This knowledge allows homeowners to negotiate loan terms effectively and secure a mortgage that aligns with their financial objectives. For instance, a homeowner can explore the impact of a larger down payment on their monthly payments and total interest paid, or they can assess the implications of a shorter loan term on their overall loan cost.Finding and Using a Homeowner Loan Calculator

Finding the right homeowner loan calculator can significantly simplify the process of understanding your potential loan options and making informed financial decisions. Numerous online resources offer free and user-friendly calculators, providing valuable insights into your mortgage payments, interest rates, and overall loan costs.

Finding the right homeowner loan calculator can significantly simplify the process of understanding your potential loan options and making informed financial decisions. Numerous online resources offer free and user-friendly calculators, providing valuable insights into your mortgage payments, interest rates, and overall loan costs.

Choosing the Right Calculator

Selecting the right calculator for your specific needs involves considering various factors, such as the type of loan you're interested in, the features offered by the calculator, and the level of detail you require.- Loan Type: Ensure the calculator supports the type of loan you're exploring, such as conventional, FHA, VA, or USDA loans. Different loan types have varying interest rates, terms, and eligibility requirements, and a calculator designed for a specific loan type will provide more accurate results.

- Features: Consider features such as amortization schedules, loan term options, and the ability to factor in property taxes and insurance. These features can provide a more comprehensive picture of your monthly payments and overall loan costs.

- Ease of Use: Choose a calculator with a clear and intuitive interface that allows you to easily input your loan information and understand the results.

- Accuracy and Reliability: Opt for calculators from reputable sources, such as financial institutions, government agencies, or well-known personal finance websites. These sources generally ensure the accuracy of their calculators and provide reliable results.

Interpreting the Results

Once you've entered your information and generated results, it's essential to understand how to interpret them and use them to make informed decisions.- Monthly Payment: The calculator will display your estimated monthly payment, which includes principal, interest, property taxes, and insurance. This figure will help you determine if you can comfortably afford the loan.

- Total Interest Paid: The calculator will also show the total amount of interest you'll pay over the life of the loan. This information is crucial for comparing different loan options and choosing the most cost-effective one.

- Loan Amortization Schedule: Some calculators provide an amortization schedule, which details how your loan payments are applied over time. This can help you visualize how much of your payment goes towards principal and interest each month.

- Loan Term: The calculator will display the length of the loan, typically expressed in years. The loan term significantly affects your monthly payment and total interest paid. A shorter term generally results in higher monthly payments but lower overall interest costs.

Reputable Online Resources for Homeowner Loan Calculators

Several reputable online resources offer homeowner loan calculators, including:- Bankrate: Bankrate provides a comprehensive mortgage calculator that allows you to compare different loan types, terms, and interest rates.

- NerdWallet: NerdWallet offers a user-friendly mortgage calculator that considers factors such as property taxes and insurance, providing a more accurate estimate of your monthly payments.

- Zillow: Zillow's mortgage calculator is integrated into their property search platform, allowing you to estimate loan costs for specific homes you're interested in.

- The United States Department of Housing and Urban Development (HUD): HUD provides a mortgage calculator specifically for FHA loans, which can be helpful for borrowers seeking government-backed financing.

- The United States Department of Veterans Affairs (VA): VA offers a mortgage calculator for eligible veterans and active-duty military personnel, providing information about VA loan terms and costs.

Examples of Homeowner Loan Scenarios: Home Owner Loan Calculator

Understanding how different loan scenarios impact monthly payments and total cost is crucial for informed decision-making. This section explores various loan scenarios using a homeowner loan calculator to illustrate the financial implications of different loan types, amounts, interest rates, and loan terms.Loan Scenario Examples and Analysis

The following table presents four different loan scenarios, each with varying loan types, amounts, interest rates, and loan terms. These scenarios are designed to demonstrate the impact of these factors on monthly payments and total loan cost.| Loan Type | Loan Amount | Interest Rate | Loan Term |

|---|---|---|---|

| Conventional Mortgage | $300,000 | 4.5% | 30 years |

| FHA Loan | $250,000 | 3.75% | 30 years |

| VA Loan | $400,000 | 4.25% | 15 years |

| Home Equity Loan | $50,000 | 6.00% | 10 years |

| Loan Type | Loan Amount | Interest Rate | Loan Term | Monthly Payment | Total Cost |

|---|---|---|---|---|---|

| Conventional Mortgage | $300,000 | 4.5% | 30 years | $1,519.69 | $547,088.40 |

| FHA Loan | $250,000 | 3.75% | 30 years | $1,147.87 | $413,233.20 |

| VA Loan | $400,000 | 4.25% | 15 years | $3,157.27 | $568,309.20 |

| Home Equity Loan | $50,000 | 6.00% | 10 years | $591.56 | $70,987.20 |

Additional Considerations

While a homeowner loan calculator is a valuable tool for estimating potential loan payments and exploring different loan options, it's crucial to remember that these calculations are just estimates. Several other factors beyond those considered by the calculator can significantly impact your overall loan experience.

It's essential to approach homeowner loans with a comprehensive understanding of your personal financial situation and goals, as well as the specific terms and conditions of the loan agreement.

While a homeowner loan calculator is a valuable tool for estimating potential loan payments and exploring different loan options, it's crucial to remember that these calculations are just estimates. Several other factors beyond those considered by the calculator can significantly impact your overall loan experience.

It's essential to approach homeowner loans with a comprehensive understanding of your personal financial situation and goals, as well as the specific terms and conditions of the loan agreement.

Understanding Your Personal Financial Situation

Before applying for a homeowner loan, it's essential to assess your current financial situation and future financial goals. This includes:- Current income and expenses: Evaluating your income and expenses will help you determine how much you can comfortably afford to pay each month for a homeowner loan. Consider your monthly income, fixed expenses (rent, utilities, transportation), and discretionary spending.

- Existing debt obligations: Analyze your existing debt, including credit card balances, student loans, and car payments. High debt levels can limit your borrowing capacity and increase your overall financial burden.

- Savings and assets: Assessing your savings and assets can help you determine how much you can contribute to a down payment and potentially reduce your overall loan amount.

- Credit score: Your credit score plays a significant role in determining your loan interest rate. A higher credit score generally leads to lower interest rates, saving you money in the long run.

Understanding Loan Terms and Conditions

Once you've assessed your financial situation, carefully review the terms and conditions of any loan agreement before signing. Key factors to consider include:- Interest rate: The interest rate is the cost of borrowing money. A lower interest rate will result in lower monthly payments and less overall interest paid over the life of the loan.

- Loan term: The loan term is the duration of the loan. A longer loan term will result in lower monthly payments but will also lead to higher overall interest paid.

- Loan fees: Loan fees can include origination fees, closing costs, and other charges. These fees can add to the overall cost of the loan, so it's essential to factor them into your calculations.

- Prepayment penalties: Some loan agreements may include prepayment penalties, which can discourage you from paying off your loan early.

Seeking Professional Financial Advice

Making major financial decisions, such as taking out a homeowner loan, can be overwhelming. Seeking professional financial advice from a qualified financial advisor can provide valuable insights and guidance. A financial advisor can help you:- Develop a personalized financial plan: A financial advisor can help you create a comprehensive financial plan that aligns with your individual goals and circumstances.

- Evaluate loan options: A financial advisor can help you compare different loan options and identify the best fit for your needs and financial situation.

- Negotiate loan terms: A financial advisor can help you negotiate favorable loan terms, such as a lower interest rate or fewer fees.

- Manage your debt: A financial advisor can help you develop a strategy for managing your debt and minimizing interest charges.