The icici home loan EMI calculator is a powerful tool that empowers prospective homeowners to make informed financial decisions. It's more than just a calculator; it's a roadmap to understanding the complexities of home loan repayments. This comprehensive guide delves into the intricacies of the ICICI Home Loan EMI calculator, unraveling its features, benefits, and how it can be effectively utilized to navigate the world of home financing.

The calculator operates by considering key factors like loan amount, interest rate, and loan tenure. These variables are interconnected, and the calculator allows you to explore different scenarios, visualize the impact of each factor on your monthly payments, and ultimately, make a well-informed decision about your home loan.

Understanding ICICI Home Loan EMI Calculator

The ICICI Home Loan EMI Calculator is a valuable tool for prospective homebuyers who want to estimate their monthly loan repayments before applying for a home loan. It helps in understanding the financial implications of taking a home loan and making informed decisions about affordability.Purpose and Functionality

The ICICI Home Loan EMI calculator is designed to calculate the Equated Monthly Installment (EMI) for a home loan based on various parameters. The calculator uses a formula to determine the monthly payment amount that includes principal and interest components. It takes into account the loan amount, interest rate, and loan tenure to calculate the EMI.Key Features and Benefits

The ICICI Home Loan EMI calculator offers several features and benefits that make it a useful tool for home loan planning:- Easy to Use: The calculator is user-friendly and requires minimal input. Users simply need to enter the loan amount, interest rate, and loan tenure to get an instant EMI estimate.

- Real-time Calculation: The calculator provides immediate results based on the entered parameters, eliminating the need for manual calculations or waiting for a response from a loan officer.

- Scenario Planning: The calculator allows users to experiment with different loan scenarios by adjusting the loan amount, interest rate, and loan tenure. This helps in exploring different options and determining the most suitable loan plan.

- financial planning: By providing an estimate of the monthly repayment amount, the calculator helps individuals plan their finances effectively. They can allocate their income accordingly and ensure they can comfortably afford the loan repayments.

- Loan Affordability: The calculator assists in determining the affordability of a home loan. Users can see how much they will be paying monthly and whether it fits within their budget.

Real-Life Scenarios, Icici home loan emi calculator

The icici home loan emi calculator can be used in various real-life scenarios to make informed decisions about home loan financing:- Pre-loan Application: Before applying for a home loan, individuals can use the calculator to estimate their monthly repayments based on their desired loan amount, interest rate, and loan tenure. This helps them determine their affordability and decide whether to proceed with the application.

- Loan Comparison: The calculator can be used to compare different loan options from different lenders. By inputting the same loan amount, interest rate, and loan tenure for different lenders, users can see the variation in EMI amounts and choose the most favorable option.

- Loan Prepayment Planning: The calculator can help individuals plan for prepayment of their home loan. By inputting the loan amount, interest rate, and loan tenure, and then adjusting the prepayment amount and duration, users can see how prepayment affects their EMI and overall loan tenure.

Factors Influencing EMI Calculation

The EMI (Equated Monthly Installment) for a home loan is calculated based on several factors that determine the affordability and repayment schedule of the loan. Understanding these factors is crucial for borrowers to make informed decisions and plan their finances effectively.

The EMI (Equated Monthly Installment) for a home loan is calculated based on several factors that determine the affordability and repayment schedule of the loan. Understanding these factors is crucial for borrowers to make informed decisions and plan their finances effectively.

Loan Amount

The loan amount is the principal amount borrowed from the lender. It directly impacts the EMI, with a higher loan amount leading to a larger EMI. For instance, a loan of ₹50 lakh will have a higher EMI than a loan of ₹30 lakh, assuming all other factors remain constant.Interest Rate

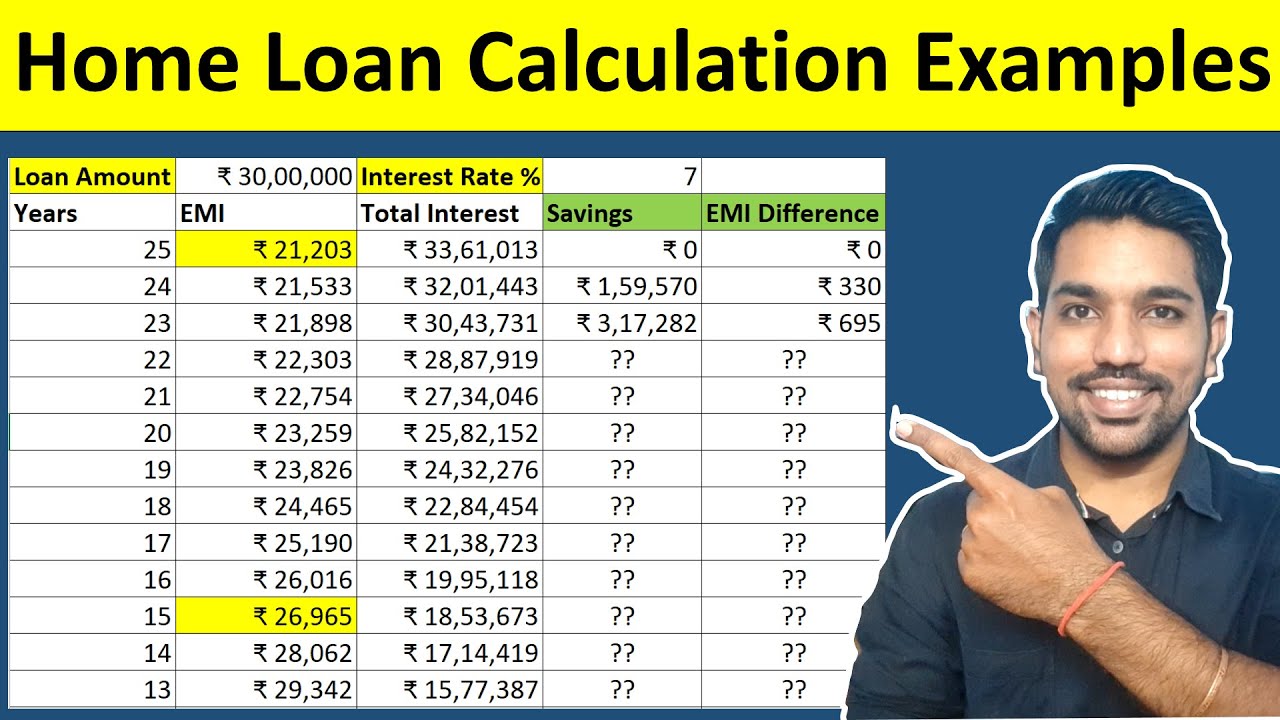

The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. It significantly influences the EMI. A higher interest rate will result in a larger EMI. For example, a loan with a 7% interest rate will have a higher EMI compared to a loan with a 6% interest rate, assuming the loan amount and tenure are the same.Loan Tenure

The loan tenure refers to the duration of the loan repayment period, typically expressed in years. It plays a crucial role in EMI calculation. A longer tenure leads to a smaller EMI but results in higher overall interest payments. Conversely, a shorter tenure leads to a larger EMI but results in lower overall interest payments. For example, a loan with a tenure of 20 years will have a smaller EMI compared to a loan with a tenure of 15 years, assuming the loan amount and interest rate are the same.EMI = [P x R x (1+R)^N] / [(1+R)^N-1]Where: * P = Loan amount * R = Interest rate per month (Annual interest rate / 12) * N = Loan tenure in months

Example of EMI Calculation

Consider a home loan of ₹50 lakh with an interest rate of 7% per annum and a tenure of 20 years. * Loan amount (P) = ₹50,00,000 * Interest rate per month (R) = 7% / 12 = 0.00583 * Loan tenure in months (N) = 20 years x 12 months/year = 240 months Plugging these values into the formula, the EMI would be approximately ₹39,654. This example illustrates how the EMI is influenced by the loan amount, interest rate, and tenure. By adjusting these factors, borrowers can find a loan option that suits their financial situation and repayment capabilities.Analyzing EMI Calculations: Icici Home Loan Emi Calculator

Understanding how EMI is calculated is crucial for effective financial planning. By analyzing different EMI scenarios, you can make informed decisions about your home loan.

Understanding how EMI is calculated is crucial for effective financial planning. By analyzing different EMI scenarios, you can make informed decisions about your home loan.

Comparing EMI Scenarios

Different loan amounts, interest rates, and loan tenures significantly impact your EMI. Here's a table illustrating the impact of varying these parameters:| Loan Amount | Interest Rate | Loan Tenure (Years) | EMI |

|---|---|---|---|

| ₹ 50,00,000 | 8.00% | 20 | ₹ 44,392 |

| ₹ 75,00,000 | 8.50% | 25 | ₹ 69,484 |

| ₹ 1,00,00,000 | 9.00% | 30 | ₹ 91,477 |

Understanding the Significance of EMI Calculations

Understanding EMI calculations helps you:- Plan your finances effectively: Knowing your EMI allows you to allocate your income accordingly, ensuring you can comfortably manage your monthly expenses and loan repayments.

- Compare loan offers: You can compare different loan offers from various lenders by calculating the EMI for each and choosing the most favorable option.

- Make informed decisions: Understanding the factors influencing EMI helps you make informed decisions about your loan amount, interest rate, and loan tenure to best suit your financial situation.

It's important to note that the EMI is calculated using a formula that considers the loan amount, interest rate, and loan tenure.By analyzing EMI calculations, you gain valuable insights into the cost of your home loan and can make informed decisions that align with your financial goals.

Additional Considerations

While the EMI calculator provides a valuable estimate of your monthly repayment, several other factors can significantly influence the overall cost of your home loan. Understanding these factors can help you make informed decisions and choose a loan that best suits your financial circumstances.Processing Fees

Processing fees are charges levied by the lender for processing your home loan application. These fees cover the administrative costs associated with verifying your eligibility, evaluating your loan application, and disbursing the loan amount.- Processing fees vary depending on the lender and the loan amount. They are typically a percentage of the loan amount, ranging from 0.25% to 1%.

- It is crucial to factor in these fees when calculating the total cost of your home loan, as they can add a significant amount to your overall expenses.

Prepayment Options

Prepayment options allow you to repay your loan amount ahead of schedule, either in part or in full.- Prepayment can help you save on interest costs and reduce the overall loan tenure.

- Some lenders offer flexible prepayment options, allowing you to make partial prepayments without any penalties.

- Others may impose prepayment penalties, typically a percentage of the prepayment amount. It is essential to understand the prepayment terms and conditions of your loan before making any prepayments.

Loan Insurance

Loan insurance is a type of insurance policy that protects your lender against financial losses in case of your death or disability.- If you are the primary borrower and pass away or become disabled, the insurance policy will cover the outstanding loan amount, relieving your family from the burden of repayment.

- Loan insurance is typically optional, but it is advisable to consider it, especially if you have dependents or if your income is the primary source of repayment.

- The cost of loan insurance is usually a percentage of the loan amount and is added to your monthly EMI.

Choosing the Right Home Loan

Choosing the right home loan requires careful consideration of your individual needs and financial circumstances.- Loan Amount: Determine the maximum loan amount you can afford based on your income, expenses, and credit score.

- Interest Rate: Compare interest rates from different lenders and choose the lowest rate possible. Consider fixed or variable interest rates based on your risk tolerance and future financial projections.

- Loan Tenure: Select a loan tenure that fits your budget and repayment capacity. A longer tenure will result in lower EMIs but higher overall interest costs. A shorter tenure will have higher EMIs but lower interest costs.

- Repayment Flexibility: Look for lenders that offer flexible repayment options, such as prepayment facilities, step-up EMIs, or balance transfer options.

- Loan Processing Fees: Compare processing fees across different lenders and choose the option with the lowest fees.

- Loan Insurance: Evaluate whether loan insurance is necessary based on your individual circumstances and consider the cost and coverage offered by different lenders.

Comparing Home Loan Options

When comparing different home loan options, consider the following factors:- Interest Rate: Compare the interest rates offered by different lenders and choose the lowest rate possible.

- Loan Tenure: Consider the loan tenure offered by each lender and choose a tenure that fits your budget and repayment capacity.

- Processing Fees: Compare processing fees across different lenders and choose the option with the lowest fees.

- Prepayment Options: Evaluate the prepayment options offered by each lender and choose a lender that allows flexible prepayments without any penalties.

- Loan Insurance: Compare the cost and coverage of loan insurance offered by different lenders and choose the option that best suits your needs.