The ICICI Home Loan Calculator is a powerful tool that empowers prospective homebuyers to make informed financial decisions. It provides a comprehensive overview of potential loan scenarios, allowing users to explore various loan amounts, interest rates, and repayment terms. By understanding the impact of these factors on monthly payments, total interest payable, and loan amortization schedules, individuals can effectively plan their home purchase and ensure financial stability.

The calculator's user-friendly interface and intuitive design make it accessible to everyone, regardless of their financial expertise. It simplifies the complex world of home financing, allowing users to quickly and easily calculate their affordability and explore different loan options. This comprehensive analysis empowers individuals to make well-informed decisions that align with their financial goals and aspirations.

Understanding ICICI Home Loan Calculator

The ICICI Home Loan Calculator is a valuable tool for potential homebuyers. It allows users to estimate their monthly mortgage payments, calculate the total loan amount they can afford, and explore different loan options. This tool empowers users to make informed decisions about their home financing needs.

The ICICI Home Loan Calculator is a valuable tool for potential homebuyers. It allows users to estimate their monthly mortgage payments, calculate the total loan amount they can afford, and explore different loan options. This tool empowers users to make informed decisions about their home financing needs.

Key Features and Benefits

The ICICI home loan calculator offers several features and benefits that make it a useful resource for homebuyers. These features streamline the process of understanding loan options and make it easier to plan for homeownership.- Loan Amount Calculation: The calculator allows users to input their desired loan amount, interest rate, and loan tenure. It then calculates the estimated monthly payment, total interest payable, and the total amount to be repaid. This helps users understand the financial implications of different loan amounts.

- EMI Calculation: The calculator also enables users to calculate their Equated Monthly Installment (EMI) based on their desired loan amount, interest rate, and loan tenure. This helps users determine if the monthly payments are within their budget.

- Loan Tenure Options: Users can explore different loan tenures to see how the monthly payments and total interest payable change. This flexibility allows users to find a loan term that best suits their financial situation and repayment capabilities.

- Interest Rate Comparison: The calculator enables users to compare interest rates from different lenders. This allows users to identify the most competitive interest rates and potentially save money on their home loan.

- Prepayment Options: The calculator may offer the option to explore prepayment scenarios, allowing users to understand the impact of prepaying their loan on their overall interest payable and loan tenure. This feature helps users explore strategies for reducing their loan burden.

How the Calculator Helps Homebuyers

The ICICI Home Loan Calculator serves as a powerful tool for homebuyers, aiding them in making informed decisions about their home financing needs.- Financial Planning: The calculator helps users estimate their monthly mortgage payments and total loan cost. This information allows users to plan their finances effectively and ensure that they can comfortably afford a home loan.

- Loan Comparison: The calculator allows users to compare different loan options from various lenders. This helps users find the best loan terms and interest rates that suit their financial situation and needs.

- Budgeting: The calculator helps users determine if the monthly payments are within their budget. This enables users to make informed decisions about their homeownership plans, ensuring that they can comfortably manage their loan repayments.

- Prepayment Planning: The calculator can help users explore prepayment options and understand their impact on their loan tenure and interest payable. This information allows users to strategize their loan repayment and potentially save on interest costs.

Key Inputs and Outputs of the Calculator

The icici home loan calculator is a valuable tool for prospective homebuyers. It simplifies the process of estimating loan affordability by providing a clear picture of potential monthly payments, total interest payable, and the loan's amortization schedule. The calculator's accuracy relies on the user's input of essential details, which directly influence the output generated.

The icici home loan calculator is a valuable tool for prospective homebuyers. It simplifies the process of estimating loan affordability by providing a clear picture of potential monthly payments, total interest payable, and the loan's amortization schedule. The calculator's accuracy relies on the user's input of essential details, which directly influence the output generated.

Essential Inputs

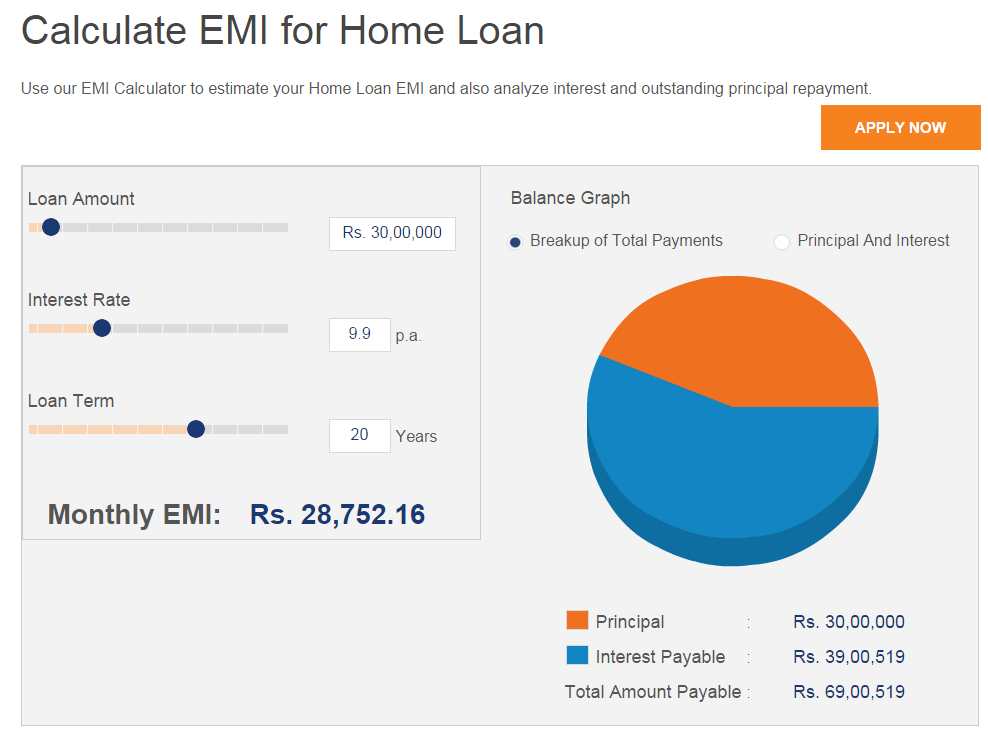

The icici home loan Calculator requires specific inputs to provide accurate estimations. These inputs represent the core elements of a home loan and play a crucial role in determining the financial implications.- Loan Amount: This input represents the total amount of money the borrower seeks to borrow from ICICI Bank. The loan amount directly influences the overall cost of the loan, including the monthly payments and total interest payable. For example, a higher loan amount will result in larger monthly payments and a higher total interest payable over the loan's tenure.

- Interest Rate: This input reflects the annual percentage rate (APR) charged by ICICI Bank for the home loan. The interest rate is a significant factor in determining the overall cost of the loan. A higher interest rate will lead to increased monthly payments and a larger total interest payable. Conversely, a lower interest rate will result in lower monthly payments and a smaller total interest payable.

- Loan Tenure: This input represents the duration of the home loan, expressed in years. The loan tenure significantly influences the monthly payments and total interest payable. A longer loan tenure will result in smaller monthly payments but a higher total interest payable due to a longer repayment period. Conversely, a shorter loan tenure will lead to larger monthly payments but a lower total interest payable due to a shorter repayment period.

- Down Payment: This input represents the initial amount of money the borrower contributes towards the purchase of the property. The down payment is typically a percentage of the property's total cost and reduces the amount borrowed from the bank. A higher down payment will result in a lower loan amount, leading to smaller monthly payments and a lower total interest payable.

Generated Outputs

The ICICI Home Loan Calculator generates various outputs based on the user's input. These outputs provide valuable insights into the financial implications of the home loan, helping borrowers make informed decisions.- Estimated Monthly Payments: This output represents the estimated amount the borrower will need to pay each month to repay the loan. The monthly payment is calculated based on the loan amount, interest rate, and loan tenure. A higher loan amount, interest rate, or longer tenure will result in larger monthly payments.

- Total Interest Payable: This output represents the total amount of interest the borrower will pay over the loan's tenure. The total interest payable is influenced by the loan amount, interest rate, and loan tenure. A higher loan amount, interest rate, or longer tenure will result in a higher total interest payable.

- Loan Amortization Schedule: This output provides a detailed breakdown of the loan repayment schedule, showing the principal and interest components of each monthly payment. The amortization schedule allows borrowers to track the progress of their loan repayment and understand how their payments are allocated over time. For example, in the initial years of the loan, a larger portion of the monthly payment goes towards interest, while in later years, a larger portion goes towards principal repayment.

Impact of Input Values on Outputs

Different input values will significantly impact the outputs generated by the calculator. Understanding these relationships is crucial for making informed decisions about a home loan.- Loan Amount: Increasing the loan amount will lead to higher monthly payments and a higher total interest payable. Conversely, decreasing the loan amount will result in lower monthly payments and a lower total interest payable. For example, a loan amount of ₹50 lakh will result in higher monthly payments and a higher total interest payable compared to a loan amount of ₹40 lakh, assuming other inputs remain constant.

- Interest Rate: A higher interest rate will lead to increased monthly payments and a larger total interest payable. Conversely, a lower interest rate will result in lower monthly payments and a smaller total interest payable. For example, an interest rate of 8% will result in higher monthly payments and a higher total interest payable compared to an interest rate of 7%, assuming other inputs remain constant.

- Loan Tenure: A longer loan tenure will result in smaller monthly payments but a higher total interest payable. Conversely, a shorter loan tenure will lead to larger monthly payments but a lower total interest payable. For example, a loan tenure of 20 years will result in smaller monthly payments but a higher total interest payable compared to a loan tenure of 15 years, assuming other inputs remain constant.

- Down Payment: A higher down payment will result in a lower loan amount, leading to smaller monthly payments and a lower total interest payable. Conversely, a lower down payment will result in a higher loan amount, leading to larger monthly payments and a higher total interest payable. For example, a down payment of 20% will result in lower monthly payments and a lower total interest payable compared to a down payment of 10%, assuming other inputs remain constant.

Additional Features and Resources: Icici Home Loan Calculator

The ICICI Home Loan Calculator offers additional features and resources to help you understand and manage your home loan. These features provide valuable insights into your loan options, enabling you to make informed decisions.

The ICICI Home Loan Calculator offers additional features and resources to help you understand and manage your home loan. These features provide valuable insights into your loan options, enabling you to make informed decisions.

Prepayment Options, Icici home loan calculator

The calculator allows you to explore prepayment options, which can help you save on interest payments and reduce the overall loan tenure. Prepayment involves making extra payments towards your loan principal, thereby reducing the outstanding loan amount and interest accrued. This can be done through lump sum payments or increasing your regular EMI amount.EMI Calculator

The ICICI Home Loan Calculator includes an EMI calculator that allows you to estimate your monthly installments based on various loan parameters such as loan amount, interest rate, and loan tenure. This feature helps you understand the financial implications of different loan scenarios and plan your finances accordingly.Loan Eligibility Check

The calculator offers a loan eligibility check feature, which provides an estimate of your loan eligibility based on your income, credit score, and other financial factors. This helps you understand the maximum loan amount you can potentially qualify for, allowing you to plan your home purchase accordingly.Additional Resources

The ICICI Bank website provides comprehensive information on home loans, including FAQs, loan terms and conditions, and customer support contact information.Key Features and Benefits

| Feature | Benefits |

|---|---|

| Prepayment Options | Save on interest payments and reduce loan tenure |

| EMI Calculator | Estimate monthly installments based on different loan scenarios |

| Loan Eligibility Check | Understand your potential loan eligibility based on your financial profile |

| Additional Resources | Access comprehensive information, FAQs, and customer support |