Home loan calculator icici - The ICICI Home Loan Calculator is a powerful tool designed to empower individuals like you to make informed decisions about your home loan journey. At the heart of this calculator lies ICICI Bank, a renowned financial institution offering a diverse range of home loan solutions. This calculator goes beyond simple calculations; it acts as your personal financial advisor, guiding you through the complexities of home loan planning.

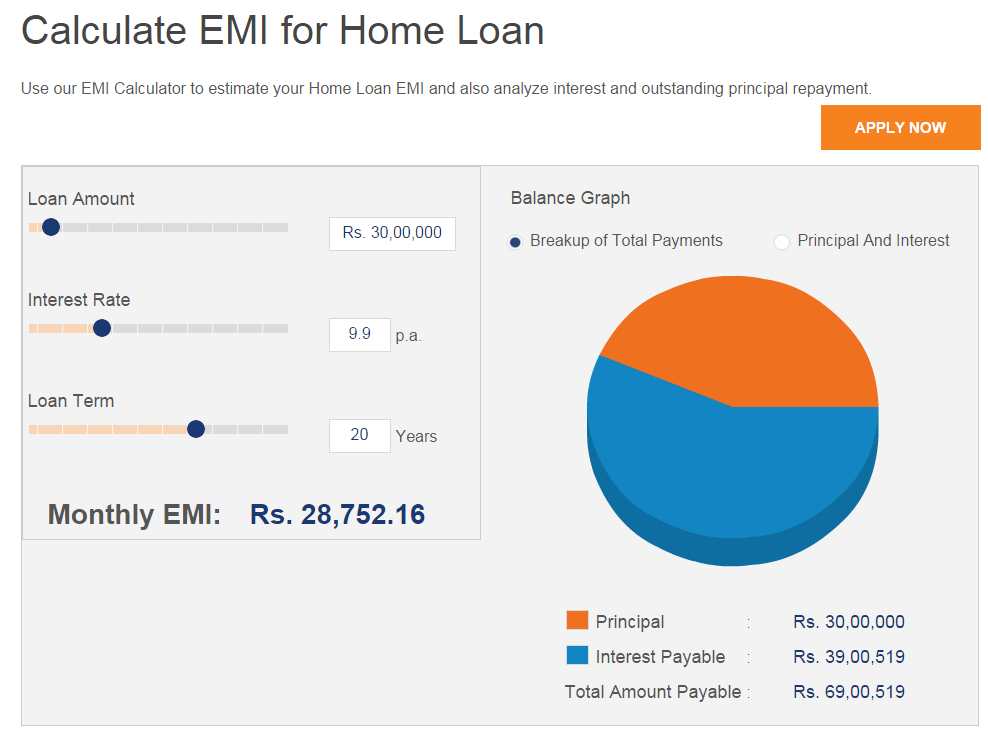

This user-friendly calculator allows you to explore various loan scenarios, providing insights into monthly payments, total interest payable, and loan tenure. By inputting your desired loan amount, interest rate, and repayment period, you can instantly generate customized estimates that reveal the true cost of your homeownership dream. The calculator empowers you to make informed decisions by presenting a clear picture of your financial obligations, allowing you to align your aspirations with your financial realities.

Introduction to ICICI Home Loan Calculator: Home Loan Calculator Icici

home loan calculator icici" title="Icici loan calculator bank" />

The icici home loan calculator is a user-friendly online tool designed to help potential homebuyers estimate their monthly loan repayments, calculate the total loan amount they can afford, and understand the overall cost of their home loan. It simplifies the process of planning and budgeting for a home purchase by providing quick and accurate calculations based on various loan parameters.

home loan calculator icici" title="Icici loan calculator bank" />

The icici home loan calculator is a user-friendly online tool designed to help potential homebuyers estimate their monthly loan repayments, calculate the total loan amount they can afford, and understand the overall cost of their home loan. It simplifies the process of planning and budgeting for a home purchase by providing quick and accurate calculations based on various loan parameters.

Overview of ICICI Bank and its Home Loan Offerings

ICICI Bank is one of India's leading private sector banks, offering a wide range of financial products and services, including home loans. The bank's home loan offerings are designed to cater to diverse needs and financial situations, with flexible repayment options and competitive interest rates. ICICI Bank's home loans are known for their transparency, quick processing, and minimal documentation requirements.Benefits of Using the ICICI Home Loan Calculator

Using the ICICI Home Loan Calculator offers numerous benefits for home loan planning:- Quick and Easy Calculations: The calculator provides instant results based on the input parameters, eliminating the need for manual calculations. This allows users to explore different loan scenarios and make informed decisions.

- Understanding Loan Affordability: The calculator helps users determine the maximum loan amount they can afford based on their income, existing liabilities, and desired repayment tenure. This ensures that they don't overextend themselves financially.

- Exploring Different Loan Options: The calculator allows users to experiment with different loan amounts, interest rates, and repayment tenures to understand the impact on their monthly payments and total loan cost. This helps them choose the most suitable loan option based on their individual circumstances.

- financial planning: The calculator provides a clear picture of the financial implications of a home loan, enabling users to plan their finances effectively. They can allocate funds for down payments, monthly repayments, and other associated expenses.

Key Features of the Calculator

The icici home loan Calculator is a user-friendly tool designed to provide quick and accurate estimates of home loan repayments. It simplifies the process of understanding loan terms and helps borrowers make informed financial decisions.

The calculator leverages several key features to provide comprehensive information about home loan repayment.

The icici home loan Calculator is a user-friendly tool designed to provide quick and accurate estimates of home loan repayments. It simplifies the process of understanding loan terms and helps borrowers make informed financial decisions.

The calculator leverages several key features to provide comprehensive information about home loan repayment.

Input Parameters

The calculator requires specific input parameters to generate accurate estimates. These parameters represent the essential components of a home loan.- Loan Amount: The principal amount borrowed for the purchase of the property. This is the initial sum of money required to finance the home purchase. For example, if you are buying a property worth INR 50 lakh, and you are making a down payment of INR 10 lakh, the loan amount would be INR 40 lakh.

- Interest Rate: The annual percentage rate (APR) charged by ICICI Bank on the loan amount. This is the cost of borrowing money, expressed as a percentage of the loan amount. For instance, an interest rate of 8% per annum means that you will pay 8% of the loan amount as interest every year.

- Loan Tenure: The duration of the loan repayment period, typically expressed in years or months. It represents the time frame over which you will repay the loan. For example, a loan tenure of 20 years means you will repay the loan over a period of 20 years.

Output Parameters

The calculator outputs key figures related to the loan repayment, providing insights into the financial implications of the loan.- EMI (Equated Monthly Installment): The fixed amount payable each month to repay the loan. This includes both principal and interest components. For example, if your EMI is INR 35,000 per month, you will pay INR 35,000 every month for the entire loan tenure.

- Total Interest Payable: The total amount of interest you will pay over the entire loan tenure. This represents the cost of borrowing money for the specified period. For example, if the total interest payable is INR 20 lakh, you will pay INR 20 lakh in interest charges over the loan tenure.

- Loan Amortization Schedule: A detailed breakdown of the principal and interest components of each EMI payment over the loan tenure. This allows you to track the progress of your loan repayment and understand how the principal and interest portions are distributed across each payment.

The EMI calculation formula is: EMI = [P * R * (1+R)^N] / [(1+R)^N-1] Where: P = Loan amount R = Monthly interest rate (annual interest rate / 12) N = Loan tenure in months

Understanding Loan Calculations

The ICICI home loan calculator simplifies the process of estimating your monthly payments, total interest, and loan tenure. To effectively use the calculator, it's crucial to grasp the fundamental concepts of home loan calculations.

The ICICI home loan calculator simplifies the process of estimating your monthly payments, total interest, and loan tenure. To effectively use the calculator, it's crucial to grasp the fundamental concepts of home loan calculations.

Understanding Key Loan Components, Home loan calculator icici

Understanding the components of a home loan is essential for making informed financial decisions. These components are:- Principal: This represents the initial amount borrowed from the lender. It's the actual cost of the property, minus any down payment you might have made.

- Interest: The lender charges interest for lending you money. This is a percentage of the principal amount, calculated over the loan tenure.

- EMI (Equated Monthly Installment): This is the fixed amount you pay monthly towards the loan. It includes both principal and interest components.

Calculating EMI

The EMI is calculated using a formula that considers the principal amount, interest rate, and loan tenure. The formula is as follows:EMI = [P x R x (1+R)^N] / [(1+R)^N-1]Where:

- P = Principal Loan Amount

- R = Monthly Interest Rate (Annual Interest Rate / 12)

- N = Loan Tenure in Months

Example: Let's say you take a loan of ₹10,00,000 (Principal) at an annual interest rate of 8% for a tenure of 20 years (240 months).

- R = 8% / 12 = 0.00667 (Monthly Interest Rate)

- EMI = [10,00,000 x 0.00667 x (1+0.00667)^240] / [(1+0.00667)^240-1]

- EMI = ₹8,364 (approximately)

Loan Repayment Methods

There are different methods for repaying a home loan, each with its own implications.- Equated Monthly Installment (EMI): This is the most common method. You pay a fixed amount every month, which includes both principal and interest. The initial payments consist mainly of interest, while the principal repayment gradually increases over time.

- Bullet Repayment: In this method, you pay only the interest amount during the loan tenure. The entire principal amount is repaid in a lump sum at the end of the loan term. This method is less common for home loans as it requires a significant cash outlay at the end.