Home improvement loan quotes are essential for anyone planning to renovate their home. Understanding the different types of loans available, the factors influencing interest rates, and the process of applying for a loan are crucial steps in ensuring a successful project. This guide delves into the intricacies of obtaining home improvement loan quotes, providing insights into navigating the financial landscape of home renovations.

From exploring various loan options like personal loans, home equity loans, and HELOCs, to comparing quotes from multiple lenders and negotiating terms, this guide equips you with the knowledge to make informed decisions about your home improvement financing. It also emphasizes the importance of consulting with contractors, obtaining necessary permits, and budgeting effectively for your project.

Understanding Home Improvement Loans

home improvement loans can be a valuable tool for homeowners looking to upgrade their properties. They allow you to finance projects that enhance your living space, increase your home's value, or improve its energy efficiency. But with various loan options available, choosing the right one for your needs can be challenging. This guide will delve into the different types of home improvement loans, their advantages and disadvantages, and examples of projects they typically cover.

home improvement loans can be a valuable tool for homeowners looking to upgrade their properties. They allow you to finance projects that enhance your living space, increase your home's value, or improve its energy efficiency. But with various loan options available, choosing the right one for your needs can be challenging. This guide will delve into the different types of home improvement loans, their advantages and disadvantages, and examples of projects they typically cover.

Personal Loans

Personal loans are unsecured loans, meaning they are not backed by collateral like your home. They offer flexibility as you can use them for various purposes, including home improvements.- Advantages: Personal loans are generally easier to qualify for than secured loans, and the approval process is often faster. They typically have fixed interest rates, allowing you to budget for your monthly payments.

- Disadvantages: Personal loans usually have higher interest rates than secured loans. You might also face penalties for early repayment.

- Kitchen or bathroom renovations

- Adding a deck or patio

- Landscaping upgrades

- Minor structural repairs

Home Equity Loans

home equity loans are secured loans backed by your home's equity, the difference between its current market value and the outstanding mortgage balance.- Advantages: Home equity loans typically have lower interest rates than personal loans because they are secured by your home. They often have fixed interest rates, making budgeting easier.

- Disadvantages: Qualifying for a home equity loan can be more challenging than getting a personal loan. If you default on the loan, you risk losing your home.

- Major kitchen or bathroom renovations

- Adding a room or an addition

- Roof replacement

- Energy-efficient upgrades like solar panels

Home Equity Lines of Credit (HELOCs)

HELOCs are revolving lines of credit secured by your home's equity. They function similarly to credit cards, allowing you to borrow money as needed, up to a pre-determined credit limit.- Advantages: HELOCs offer flexibility as you can borrow money only when you need it. They often have variable interest rates, which can be beneficial if interest rates decline.

- Disadvantages: HELOCs typically have variable interest rates, which can increase over time. You may also face higher interest rates during the draw period.

- Significant renovations

- Adding a guest suite

- Major landscaping projects

- Updating electrical or plumbing systems

Obtaining a Home Improvement Loan Quote

Securing a home improvement loan involves understanding the factors that influence loan interest rates and terms, as well as knowing how to improve your creditworthiness to qualify for the best rates. This section Artikels these factors and provides tips for enhancing your credit score to secure favorable loan terms.

Securing a home improvement loan involves understanding the factors that influence loan interest rates and terms, as well as knowing how to improve your creditworthiness to qualify for the best rates. This section Artikels these factors and provides tips for enhancing your credit score to secure favorable loan terms.

Factors Influencing Loan Interest Rates and Terms

Lenders consider various factors when determining your loan interest rate and terms. Understanding these factors can help you navigate the loan application process effectively.- credit score: Your credit score is a crucial factor influencing interest rates. A higher credit score signifies lower risk to the lender, resulting in a lower interest rate.

- Debt-to-Income Ratio (DTI): Lenders assess your DTI, which represents the percentage of your monthly income dedicated to debt payments. A lower DTI generally leads to more favorable loan terms.

- Loan Amount: The amount you borrow influences interest rates. Larger loan amounts may come with higher interest rates.

- Loan Term: The length of the loan term impacts your monthly payments and overall interest paid. Longer terms generally result in lower monthly payments but higher total interest costs.

- Interest Rate Type: Lenders offer both fixed and variable interest rates. Fixed rates remain constant throughout the loan term, providing predictable monthly payments. Variable rates fluctuate based on market conditions, offering potential for lower initial payments but posing risks of higher rates in the future.

- Loan Purpose: The specific purpose of the loan can influence interest rates. Some lenders may offer lower rates for energy-efficient improvements or specific home renovation projects.

- Property Value: The value of your property serves as collateral for the loan. Lenders may offer better rates for properties with higher values.

Improving Your Credit Score

A higher credit score can significantly improve your chances of securing a favorable loan interest rate. Consider these strategies to enhance your credit score:- Pay Bills on Time: Consistent on-time payments are essential for a healthy credit score. Set reminders or automate payments to avoid late fees and negative impacts on your credit.

- Keep Credit Utilization Low: Credit utilization ratio refers to the percentage of available credit you use. Aim to keep this ratio below 30% for optimal credit health.

- Avoid Opening New Credit Accounts: Opening too many new credit accounts can negatively impact your credit score. Only apply for credit when necessary.

- Monitor Your Credit Report: Regularly review your credit report for errors or fraudulent activity. You can obtain free credit reports from all three major credit bureaus annually.

- Consider a Secured Credit Card: A secured credit card requires a security deposit, which helps build credit history and can improve your score over time.

Applying for a Home Improvement Loan

The application process for a home improvement loan typically involves the following steps:- Gather Financial Information: Prepare documents such as your income verification, bank statements, and credit report.

- Compare Loan Offers: Research different lenders and compare interest rates, terms, and fees.

- Complete the Application: Submit a loan application with the required information and supporting documents.

- Provide Documentation: The lender may request additional documentation, such as proof of homeownership or details of the planned improvements.

- Loan Approval: Once your application is approved, the lender will provide you with loan terms and a closing date.

- Loan Disbursement: The loan proceeds will be disbursed to you, either directly or through a contractor.

Using a Home Improvement Loan Quote

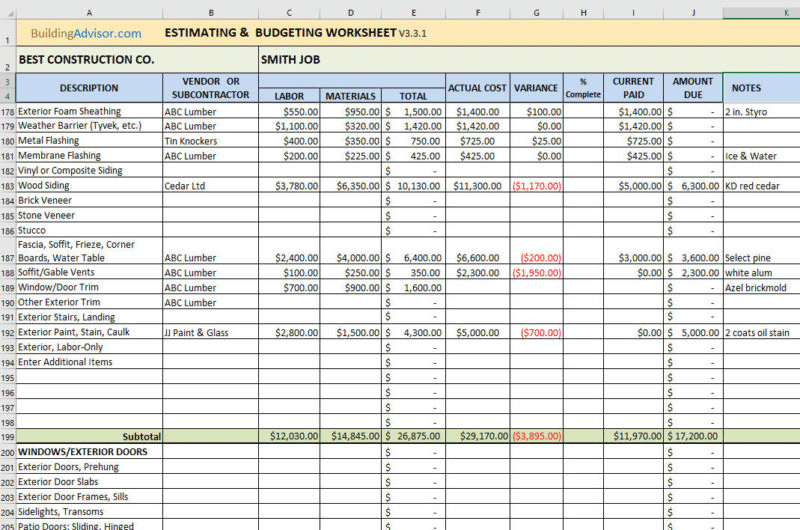

A home improvement loan quote provides a detailed breakdown of the loan terms and costs. It is a valuable tool for estimating the total cost of your project, comparing different loan offers, and making informed financial decisions.Estimating the Total Project Cost

A home improvement loan quote typically includes the loan amount, interest rate, loan term, monthly payment, and total interest paid. You can use this information to estimate the total cost of your project, including the loan amount and the associated interest and fees.To estimate the total cost, add the loan amount to the total interest paid. For example, if you borrow $10,000 at an interest rate of 5% for a 5-year term, the total interest paid would be approximately $1,276. The total cost of the project, including the loan and interest, would be $11,276.

Essential Documents for Loan Application

Before applying for a home improvement loan, it's essential to gather the necessary documents. This typically includes:- Proof of Identity: Driver's license, passport, or government-issued ID card.

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Proof of Residence: Utility bills, lease agreement, or mortgage statement.

- Credit Report: Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Home Improvement Estimates: Quotes from contractors or suppliers outlining the project scope and costs.

- Property Tax Information: Evidence of your property taxes, which may be required for some loan types.

Budgeting and Tracking Loan Repayments, Home improvement loan quote

It is crucial to create a realistic budget for your home improvement project, factoring in the loan repayments. Consider the following:- Project Costs: Account for materials, labor, permits, and any unforeseen expenses.

- Loan Repayments: Include the monthly payment amount, interest rate, and loan term.

- Other Expenses: Factor in any additional costs, such as insurance or property taxes.

Additional Considerations: Home Improvement Loan Quote

Before you embark on your home improvement journey, it's crucial to consider a few additional factors that can significantly impact your project's success and overall satisfaction. These considerations include the expertise of a qualified contractor, the necessity of permits and inspections, and the importance of safeguarding your home during renovations.

Before you embark on your home improvement journey, it's crucial to consider a few additional factors that can significantly impact your project's success and overall satisfaction. These considerations include the expertise of a qualified contractor, the necessity of permits and inspections, and the importance of safeguarding your home during renovations.

Consulting with a Qualified Contractor

Engaging a qualified contractor is essential for ensuring the quality and safety of your home improvement project. A skilled contractor brings expertise, experience, and a network of reliable subcontractors to the table.- Project Planning and Budgeting: A contractor can help you develop a realistic budget and timeline, factoring in materials, labor, and potential unforeseen expenses.

- Design and Material Selection: A contractor can provide valuable insights on design choices, material selection, and potential challenges associated with your project.

- Code Compliance and Permits: A qualified contractor is familiar with local building codes and can guide you through the permitting process, ensuring your project meets legal requirements.

- Quality Control and Workmanship: A contractor oversees the entire project, ensuring high-quality workmanship and adherence to industry standards.

Permits and Inspections

Most home improvement projects require permits and inspections to ensure they comply with local building codes and safety regulations. These permits are essential for:- Safety: Permits and inspections help ensure that your project meets safety standards, protecting you and your family from potential hazards.

- Code Compliance: Permits guarantee that your project adheres to local building codes, preventing future issues and potential legal ramifications.

- Property Value: Completed projects with proper permits and inspections increase the value of your home and enhance its marketability.

It's crucial to consult with your local building department to determine the necessary permits and inspections for your specific home improvement project.

Protecting Your Home During Renovation

Renovations can be disruptive and dusty, requiring proactive measures to protect your home and belongings.- Covering Furniture and Floors: Protect furniture and flooring with drop cloths, plastic sheeting, or furniture covers.

- Dust Control: Utilize dust containment methods like plastic barriers and HEPA-filtered vacuums to minimize dust spread.

- Ventilation: Ensure adequate ventilation to prevent moisture buildup and mold growth during and after renovations.

- Security: Secure your home during renovation work by locking doors and windows, and consider installing a security system if necessary.