home equity loan nationwide - Home equity loans nationwide offer homeowners a unique opportunity to access funds secured by the equity built in their homes. These loans, often referred to as second mortgages, allow borrowers to tap into their property's value for various financial needs, from home improvements and debt consolidation to educational expenses and even investment opportunities. However, understanding the intricacies of home equity loans, including eligibility criteria, interest rates, and potential risks, is crucial before making a decision.

This guide delves into the world of home equity loans nationwide, providing a comprehensive overview of their workings, benefits, and drawbacks. We explore the various types of loans available, the application process, and essential factors to consider when managing these financial instruments. By understanding the nuances of home equity loans, homeowners can make informed decisions about whether this financing option aligns with their financial goals and risk tolerance.

Home Equity Loan Basics

A home equity loan, also known as a second mortgage, is a loan that uses your home's equity as collateral. Equity is the difference between your home's current market value and the amount you still owe on your mortgage. Home equity loans allow you to borrow money against the equity you have built up in your home, providing access to funds for various purposes. Home equity loans work by essentially turning your home's equity into a financial asset that can be leveraged. When you apply for a home equity loan, the lender assesses your home's value and calculates the amount of equity you possess. This amount, minus any existing debt, determines the maximum loan amount you can qualify for. The loan is then secured by your home, meaning that if you fail to repay the loan, the lender can foreclose on your property.Types of Home Equity Loans, Home equity loan nationwide

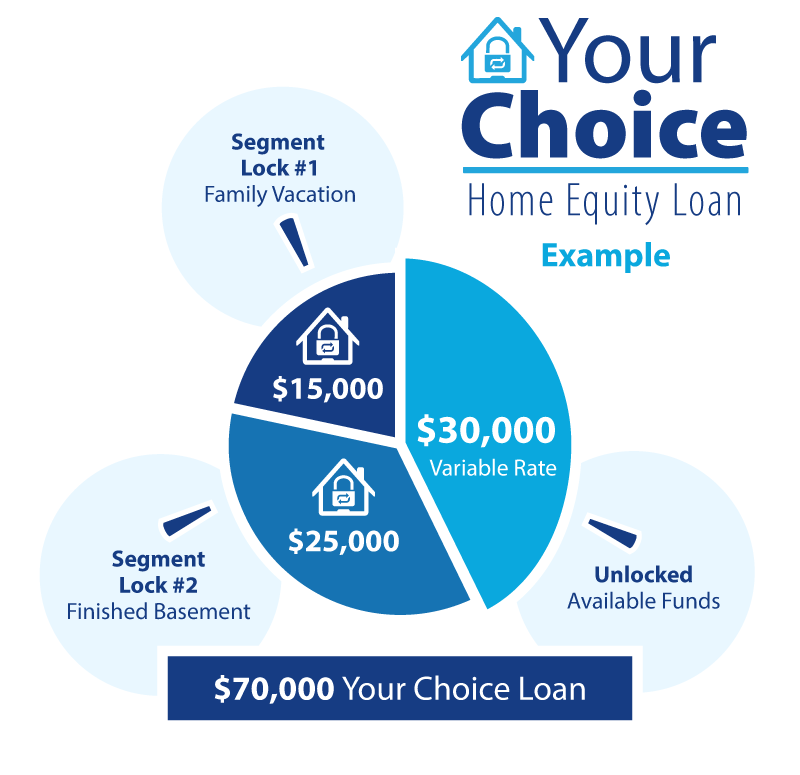

Home equity loans are available in various forms, each with its own features and benefits. The most common types of home equity loans include:- Home Equity Loan: This is a traditional home equity loan where you receive a lump sum of money upfront. You then repay the loan with fixed monthly payments over a set term, typically 5 to 30 years. Interest rates are typically fixed, providing predictability in your monthly payments.

- Home Equity Line of Credit (HELOC): A HELOC operates like a revolving credit line, allowing you to draw funds as needed up to a pre-approved credit limit. You only pay interest on the amount you borrow, and you can repay the loan over a set period, typically 10 to 20 years. HELOCs often offer variable interest rates, which can fluctuate over time.

- Cash-Out Refinance: This involves refinancing your existing mortgage with a new loan that includes a larger principal amount. The extra funds are then available to you as a cash-out. This option combines refinancing with accessing home equity, allowing you to lower your interest rate and receive a lump sum payment.

Eligibility Criteria for Home Equity Loans

Lenders have specific requirements that borrowers must meet to qualify for a home equity loan. These criteria typically include:- Credit Score: A good credit score is crucial for securing a favorable interest rate. Lenders generally require a credit score of at least 620, although some may have stricter requirements. A higher credit score often translates to lower interest rates.

- Debt-to-Income Ratio (DTI): This measures your monthly debt payments relative to your gross monthly income. Lenders typically prefer a DTI below 43%, although this can vary based on individual circumstances.

- Loan-to-Value (LTV) Ratio: This ratio compares the amount of your mortgage loan to the appraised value of your home. Lenders generally prefer an LTV of 80% or lower, meaning you have at least 20% equity in your home. This minimizes their risk of loss in case of default.

- Income and Employment History: Lenders assess your income and employment history to ensure you have the financial capacity to repay the loan. Stable income and a consistent employment history are essential.

- Property Value: The value of your home plays a crucial role in determining the amount of equity you have available. A recent appraisal is usually required to assess the current market value.

Interest Rates and Loan Terms

Home equity loan interest rates and loan terms vary depending on factors such as:- credit score: Borrowers with higher credit scores generally qualify for lower interest rates.

- Loan Amount: Larger loan amounts may come with higher interest rates.

- Loan Term: Shorter loan terms typically result in higher monthly payments but lower overall interest costs. Conversely, longer loan terms have lower monthly payments but higher overall interest costs.

- Lender: Different lenders have varying interest rates and loan terms. It's essential to compare offers from multiple lenders to find the best deal.

Home equity loans can be a valuable tool for financing various needs, but it's essential to understand the risks involved before taking on such a loan.

Utilizing Home Equity Loans

Home equity loans, also known as second mortgages, allow homeowners to borrow against the equity they've built up in their homes. This equity represents the difference between the current market value of the home and the outstanding mortgage balance. Understanding the reasons behind taking out a home equity loan, its potential benefits, and drawbacks is crucial for making informed financial decisions.

Home equity loans, also known as second mortgages, allow homeowners to borrow against the equity they've built up in their homes. This equity represents the difference between the current market value of the home and the outstanding mortgage balance. Understanding the reasons behind taking out a home equity loan, its potential benefits, and drawbacks is crucial for making informed financial decisions.

Reasons for Utilizing Home Equity Loans

Homeowners often consider home equity loans for various financial needs. Some common reasons include:- Home Improvements: Homeowners may use home equity loans to finance renovations, additions, or upgrades to their homes. These improvements can enhance the value of the property, increase energy efficiency, or create a more comfortable living environment.

- debt consolidation: Home equity loans can be used to consolidate high-interest debt, such as credit card debt or personal loans. By transferring balances to a lower-interest home equity loan, homeowners can save on interest payments and potentially reduce their monthly debt obligations.

- Major Expenses: Homeowners may choose home equity loans to cover unexpected expenses, such as medical bills, educational costs, or unexpected repairs. These loans provide access to a lump sum of cash that can help address these financial emergencies.

- Investment Opportunities: In some cases, homeowners may use home equity loans to fund investment opportunities, such as starting a business or investing in real estate. However, it's important to weigh the potential risks and returns associated with such investments.

Benefits of Utilizing Home Equity Loans

home equity loans offer potential benefits, including:- Lower Interest Rates: Compared to unsecured loans, such as credit cards or personal loans, home equity loans often have lower interest rates due to the security of the home as collateral. This can result in significant savings on interest payments over the loan term.

- Fixed Interest Rates: Home equity loans typically offer fixed interest rates, which means the monthly payment remains constant throughout the loan term. This provides predictability and helps homeowners budget their finances effectively.

- Longer Loan Terms: Home equity loans generally have longer repayment terms than other forms of financing, which can result in lower monthly payments. However, it's important to consider the overall cost of the loan, including interest accrued over a longer period.

- Tax Deductibility: Interest paid on home equity loans used for home improvements may be tax-deductible, subject to certain limitations. Consulting with a tax advisor can help determine eligibility for this deduction.

Drawbacks and Risks of Home Equity Loans

While home equity loans can be beneficial, it's essential to consider potential drawbacks and risks:- Risk of Foreclosure: If a homeowner fails to make payments on a home equity loan, the lender may have the right to foreclose on the property. This could result in the loss of the home and significant financial hardship.

- Increased Debt Burden: Taking out a home equity loan increases the overall debt burden on a homeowner. It's crucial to ensure that the loan payments can be comfortably managed within the household budget.

- Negative Equity: If the value of the home decreases, the homeowner may end up with negative equity, where the outstanding loan balance exceeds the home's market value. This can make it difficult to refinance or sell the property.

- Impact on Credit Score: A home equity loan can impact a homeowner's credit score, especially if the loan increases their debt-to-income ratio. It's important to monitor credit scores and manage debt levels responsibly.

Comparison with Other Financing Options

Home equity loans are not the only option for homeowners seeking financing. It's essential to compare them with other forms of financing to determine the most suitable choice:- Personal Loans: Personal loans are unsecured loans that don't require collateral. They can be obtained faster than home equity loans but typically have higher interest rates.

- Credit Cards: Credit cards offer revolving credit, but they often come with high interest rates and fees. Using credit cards for large purchases can lead to significant debt accumulation.

- Home Improvement Loans: Some lenders offer specialized home improvement loans with lower interest rates and terms tailored to renovation projects.

Obtaining a Home Equity Loan: Home Equity Loan Nationwide

Securing a home equity loan involves a straightforward process that typically begins with an application. This application serves as a formal request for a loan, allowing lenders to assess your financial standing and determine your eligibility for the loan.The Application Process

Applying for a home equity loan usually involves the following steps:- Contact a lender: Begin by reaching out to several lenders to compare interest rates and loan terms. This could include banks, credit unions, or online lenders.

- Pre-qualification: Many lenders offer a pre-qualification process that provides a preliminary estimate of your loan amount and interest rate without affecting your credit score. This step helps you gauge your eligibility and potential loan terms.

- Formal application: Once you've chosen a lender, you'll need to complete a formal application, providing detailed financial information, including your income, debt, and credit history.

- Loan approval: The lender will review your application and assess your creditworthiness, debt-to-income ratio, and equity in your home. If approved, they'll provide you with the loan terms, including the interest rate, loan amount, and repayment schedule.

- Loan closing: The final step involves signing the loan documents and receiving the loan proceeds. This typically involves a closing meeting with a loan officer, where you'll review the loan terms and sign the necessary paperwork.

Essential Documents for Loan Applications

It's crucial to have the following documents readily available when applying for a home equity loan:- Proof of income: This could include recent pay stubs, tax returns, or W-2 forms.

- Bank statements: Provide recent bank statements for your checking and savings accounts to demonstrate your financial stability.

- Credit report: Lenders will review your credit report to assess your creditworthiness. You can obtain a free copy of your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Home appraisal: Lenders typically require a recent home appraisal to determine the current market value of your property and calculate your equity. This appraisal helps ensure that you have sufficient equity to secure the loan.

- Property tax and insurance records: Provide recent property tax and insurance bills to demonstrate your ability to maintain your property.

Shopping Around for Competitive Loan Offers

Comparing loan offers from multiple lenders is essential to securing the most favorable terms. Consider the following factors when shopping around:- Interest rates: Aim for the lowest possible interest rate to minimize your overall borrowing costs.

- Loan fees: Be aware of any origination fees, appraisal fees, or other closing costs associated with the loan. These fees can vary significantly between lenders.

- Loan terms: Compare the loan term, which is the length of time you'll have to repay the loan. Longer terms may result in lower monthly payments but could lead to higher overall interest costs.

- Loan type: Determine if a fixed-rate or variable-rate loan best suits your needs. Fixed-rate loans offer predictable monthly payments, while variable-rate loans have interest rates that fluctuate with market conditions.

Negotiating Loan Terms and Securing Favorable Rates

While lenders generally have established loan terms, there's often room for negotiation, particularly if you have a strong credit score and substantial equity in your home. Consider the following tips:- Shop around: By comparing loan offers from multiple lenders, you'll have a stronger negotiating position.

- Highlight your strengths: Emphasize your positive financial attributes, such as a high credit score, low debt-to-income ratio, and substantial equity in your home.

- Be prepared to walk away: If you're not satisfied with the lender's offer, be prepared to walk away and explore other options. This can sometimes incentivize the lender to improve their offer.

- Consider pre-payment options: Inquire about pre-payment penalties or options. The ability to make additional payments or pay off the loan early can save you on interest costs.

Nationwide Home Equity Loan Landscape

The home equity loan market is dynamic and influenced by several factors, including interest rates, economic conditions, and the real estate market. Understanding these factors is crucial for borrowers seeking home equity loans and lenders offering them.

The home equity loan market is dynamic and influenced by several factors, including interest rates, economic conditions, and the real estate market. Understanding these factors is crucial for borrowers seeking home equity loans and lenders offering them.

Current Trends and Market Conditions

The availability and terms of home equity loans are directly affected by prevailing economic conditions. During periods of economic growth and low interest rates, home equity loan availability increases, and lenders offer more competitive terms. Conversely, during periods of economic uncertainty or rising interest rates, home equity loan availability may decline, and lenders may become more cautious in their lending practices.Major Lenders and Financial Institutions

A wide range of lenders, including banks, credit unions, and online lenders, offer home equity loans nationwide.- Major banks, such as Bank of America, Chase, and Wells Fargo, have extensive branch networks and online platforms for offering home equity loans.

- Credit unions often offer lower interest rates and more personalized service than banks.

- Online lenders, like LendingTree and SoFi, provide a convenient platform for comparing loan options from multiple lenders.

Loan Terms and Rates Comparison

Loan terms and rates vary significantly among lenders, and borrowers should compare options carefully before making a decision.- Interest rates are influenced by factors such as the borrower's credit score, loan amount, and loan-to-value ratio (LTV).

- Loan terms typically range from 5 to 30 years, and borrowers should choose a term that aligns with their financial goals and repayment capacity.

- Fees associated with home equity loans can vary significantly, so borrowers should compare closing costs, origination fees, and other charges.