Home equity consolidation loans, a financial tool that leverages the equity in your home to consolidate various debts, offer a potential path to financial stability. This type of loan combines multiple debts into a single loan with a lower interest rate, potentially saving you money on interest payments and simplifying your monthly bills. However, it's crucial to understand the intricacies of home equity consolidation loans before embarking on this financial journey.

This comprehensive guide will delve into the workings of home equity consolidation loans, exploring their benefits and drawbacks, eligibility requirements, and potential risks. We'll also examine alternative debt consolidation options and provide practical tips for navigating the process effectively.

What is a Home Equity Consolidation Loan?

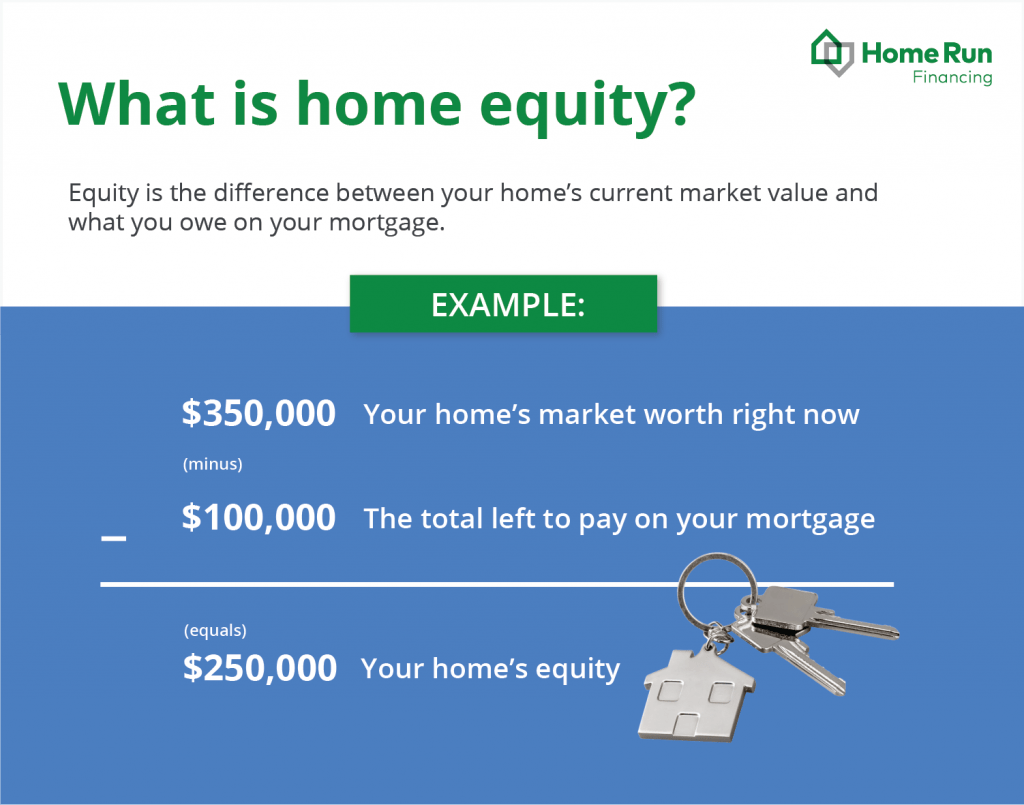

A home equity consolidation loan is a type of loan that allows homeowners to combine multiple debts, such as credit card debt, personal loans, or medical bills, into a single loan secured by their home equity.

This type of loan can be a helpful tool for borrowers who are looking to simplify their finances and potentially lower their monthly payments. By consolidating their debts into a single loan with a lower interest rate, borrowers may be able to save money on interest charges and pay off their debt faster.

A home equity consolidation loan is a type of loan that allows homeowners to combine multiple debts, such as credit card debt, personal loans, or medical bills, into a single loan secured by their home equity.

This type of loan can be a helpful tool for borrowers who are looking to simplify their finances and potentially lower their monthly payments. By consolidating their debts into a single loan with a lower interest rate, borrowers may be able to save money on interest charges and pay off their debt faster.

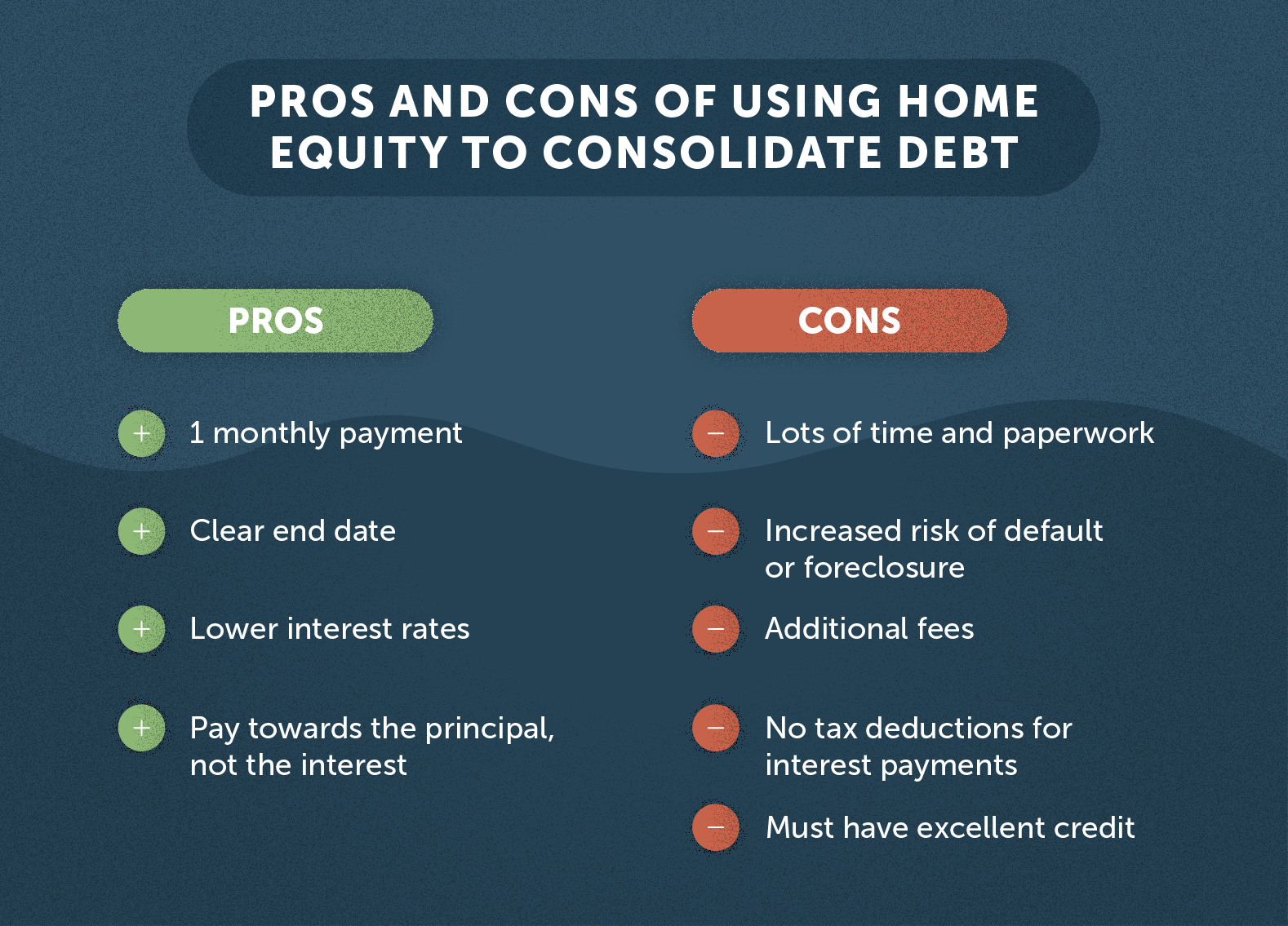

Benefits of a Home Equity Consolidation Loan

A home equity consolidation loan can offer several benefits to borrowers, including:- Lower Interest Rates: home equity loans typically have lower interest rates than credit cards or personal loans, which can save borrowers money on interest charges over time.

- Simplified Payments: Consolidating multiple debts into a single loan can simplify payment management, as borrowers only need to make one monthly payment.

- Improved Credit Score: By paying down debt, borrowers can improve their credit score, which can lead to better interest rates on future loans.

- Increased Cash Flow: By lowering monthly payments, borrowers can free up cash flow for other expenses or financial goals.

Drawbacks of a Home Equity Consolidation Loan

While home equity consolidation loans can offer benefits, they also come with potential drawbacks, including:- Risk of foreclosure: If borrowers fail to make their loan payments, they could risk losing their home.

- High Interest Rates: While home equity loans typically have lower interest rates than credit cards or personal loans, they can still have higher interest rates than other types of loans, such as mortgages.

- Loss of Equity: Using home equity to consolidate debt can reduce the amount of equity borrowers have in their home.

- Potential Tax Implications: Interest paid on home equity loans may be deductible for tax purposes, but there are limitations and restrictions.

How Home Equity Consolidation Loans Work

A home equity consolidation loan allows homeowners to combine multiple debts, such as credit cards, personal loans, and medical bills, into a single loan secured by their home's equity. This can simplify debt management, potentially lower monthly payments, and improve credit scores.

A home equity consolidation loan allows homeowners to combine multiple debts, such as credit cards, personal loans, and medical bills, into a single loan secured by their home's equity. This can simplify debt management, potentially lower monthly payments, and improve credit scores.

Obtaining a Home Equity Consolidation Loan

To obtain a home equity consolidation loan, borrowers must follow a specific process:- Contact a lender: Borrowers can start by contacting several lenders, including banks, credit unions, and online lenders, to compare interest rates, terms, and fees.

- Provide financial information: Lenders will require borrowers to provide their financial information, including their credit history, income, and debt-to-income ratio (DTI).

- Get pre-approved: After reviewing the borrower's financial information, lenders will issue a pre-approval, indicating the maximum loan amount they are willing to offer.

- Complete the application: Once borrowers have chosen a lender, they will need to complete a formal loan application and provide supporting documentation, such as pay stubs, tax returns, and property appraisal.

- Loan approval and closing: The lender will review the application and supporting documentation. If approved, the loan will be closed, and the proceeds will be used to pay off the existing debts.

Eligibility Requirements

Lenders consider several factors when determining eligibility for a home equity consolidation loan:- Credit score: Lenders typically require a minimum credit score, usually in the 620-680 range, to qualify for a home equity consolidation loan. Borrowers with higher credit scores may qualify for lower interest rates.

- Debt-to-income ratio (DTI): Lenders consider the borrower's DTI, which is the percentage of their monthly income that goes towards debt payments. A lower DTI generally improves loan approval chances.

- Home equity: Borrowers must have sufficient equity in their homes to secure the loan. Lenders typically require a minimum equity percentage, often around 15-20%.

- Income: Lenders evaluate the borrower's income to ensure they can afford the monthly loan payments.

- Employment history: Lenders may consider the borrower's employment history to assess their financial stability.

Terms and Conditions

Home equity consolidation loans typically have specific terms and conditions, including:- Interest rate: The interest rate on a home equity consolidation loan is typically variable, meaning it can fluctuate over time. It's often higher than a traditional mortgage but lower than credit card interest rates.

- Loan term: The loan term can vary depending on the lender and the borrower's needs. Common terms range from 5 to 30 years.

- Fees: Home equity consolidation loans may involve various fees, including origination fees, appraisal fees, and closing costs. These fees can add to the overall cost of the loan.

- Payment schedule: Borrowers typically make monthly payments on their home equity consolidation loan, including principal and interest.

Using a Home Equity Consolidation Loan

A home equity consolidation loan can be a valuable tool for debt management, but it's crucial to understand its uses and potential risks before making a decision. This section will explore practical examples of using a home equity consolidation loan, the potential risks associated with it, and strategies for managing debt effectively after taking out such a loan.

A home equity consolidation loan can be a valuable tool for debt management, but it's crucial to understand its uses and potential risks before making a decision. This section will explore practical examples of using a home equity consolidation loan, the potential risks associated with it, and strategies for managing debt effectively after taking out such a loan.

Examples of Using a Home Equity Consolidation Loan

Home equity consolidation loans can be used to consolidate various types of debt, offering the potential for lower interest rates and simplified monthly payments. Here are some common examples:- Consolidating High-Interest Credit Card Debt: If you have multiple credit cards with high balances and interest rates, a home equity consolidation loan can help you combine those debts into a single loan with a lower interest rate. This can significantly reduce your monthly payments and accelerate your debt repayment. For example, if you have $20,000 in credit card debt at an average interest rate of 18%, a home equity consolidation loan with a 7% interest rate could save you hundreds of dollars in interest payments each month.

- Combining Personal Loans and Other Debts: A home equity consolidation loan can also be used to consolidate personal loans, medical bills, or other unsecured debts. By combining these debts into a single loan, you can simplify your finances and potentially reduce your overall interest payments.

- Home Improvement Projects: While not strictly debt consolidation, a home equity consolidation loan can also be used to finance home improvement projects. This can be a more affordable option than traditional home improvement loans, especially if you have good credit and equity in your home.

Potential Risks and Consequences

While a home equity consolidation loan can offer benefits, it's important to be aware of the potential risks:- Risk of Losing Your Home: A home equity consolidation loan is secured by your home. If you fail to make payments, the lender could foreclose on your home, leaving you without a place to live.

- Higher Interest Rates: While a home equity consolidation loan may have a lower interest rate than some other types of debt, it's still a secured loan, meaning the interest rate could be higher than unsecured loans. If you have a history of late payments or poor credit, you may face even higher interest rates.

- Increased Debt: If you use a home equity consolidation loan to consolidate debt and then continue to accrue new debt, you could end up in a worse financial situation than before. This is especially true if you are not careful about managing your spending habits.

Strategies for Managing Debt After Using a Home Equity Consolidation Loan

After consolidating your debt with a home equity consolidation loan, it's crucial to develop a strategy for managing your finances effectively to avoid falling back into debt:- Create a Budget: A budget is essential for tracking your income and expenses. It allows you to see where your money is going and identify areas where you can cut back.

- Stick to Your Budget: Once you have a budget, stick to it as closely as possible. Avoid impulse purchases and make sure you are living within your means.

- Pay More Than the Minimum: While making the minimum payment on your home equity consolidation loan is better than nothing, it will take longer to pay off the debt and could result in more interest payments. Aim to pay more than the minimum payment whenever possible to accelerate your debt repayment.

- Avoid Taking on New Debt: Once you have consolidated your debt, avoid taking on new debt unless absolutely necessary. Focus on paying off your existing debt before incurring new expenses.

- Seek Professional Advice: If you are struggling to manage your debt, consider seeking professional financial advice from a certified financial planner or credit counselor. They can help you develop a debt management plan and provide guidance on how to improve your financial situation.

Alternatives to Home Equity Consolidation Loans

A home equity consolidation loan, while potentially beneficial, isn't the only solution for debt consolidation. Exploring alternative options is crucial to make an informed decision. Understanding the advantages and disadvantages of each method can help you find the best fit for your financial situation.Debt Consolidation Loans

Debt consolidation loans involve taking out a new loan to pay off existing debts. This can be a good option if you can secure a lower interest rate than your current debts, thus reducing your overall interest payments.- Advantages:

- Lower interest rates can save you money on interest payments.

- Simplified debt management with a single monthly payment.

- Potentially improve your credit score by reducing utilization.

- Disadvantages:

- Higher interest rates than some other options.

- Risk of extending your repayment term, potentially increasing total interest paid.

- May require a good credit score to qualify.

Balance Transfers

Balance transfers involve moving your existing credit card debt to a new credit card with a lower interest rate. This can be a good option for high-interest credit card debt, but it's important to be aware of balance transfer fees and introductory periods.- Advantages:

- Lower interest rates can save you money on interest payments.

- Can help you pay down debt faster.

- May offer a 0% introductory APR period.

- Disadvantages:

- Balance transfer fees may apply.

- Introductory periods are often temporary, after which regular interest rates may apply.

- May require a good credit score to qualify.

Debt Management Plans

Debt management plans involve working with a credit counseling agency to negotiate lower interest rates and monthly payments with your creditors. This can be a good option for individuals struggling to manage their debt, but it's important to choose a reputable credit counseling agency.- Advantages:

- Lower monthly payments can make debt management more manageable.

- Potential to reduce interest rates.

- Provides guidance and support from a credit counselor.

- Disadvantages:

- May require a monthly fee to participate.

- Can negatively impact your credit score.

- May take longer to pay off your debt.

Debt Settlement

Debt settlement involves negotiating with your creditors to pay a lump sum less than the total amount owed. This can be a good option for individuals with significant debt, but it's important to be aware of the risks involved.- Advantages:

- Can significantly reduce the amount of debt owed.

- May help you avoid bankruptcy.

- Disadvantages:

- Can damage your credit score.

- May result in tax implications.

- May not be available for all types of debt.

Personal Loans

Personal loans can be used for debt consolidation, offering a lower interest rate than credit cards. They typically come with fixed interest rates and repayment terms, providing predictability and stability.- Advantages:

- Lower interest rates than credit cards.

- Fixed interest rates and repayment terms.

- Can be used to consolidate various types of debt.

- Disadvantages:

- May require a good credit score to qualify.

- Origination fees may apply.

- Repayment terms may be longer than other options, potentially increasing total interest paid.

Debt Consolidation Advice and Support, Home equity consolidation loan

Finding reliable information and support is crucial when considering debt consolidation. Several resources can help you make informed decisions:- National Foundation for Credit Counseling (NFCC): This organization offers free credit counseling and debt management services.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources and information on debt consolidation and other financial topics.

- Local Credit Counseling Agencies: Many local organizations offer credit counseling and debt management services.

Home Equity Consolidation Loan Resources

Securing a home equity consolidation loan requires careful research and comparison of available options. This section will provide you with valuable resources to help you navigate this process.

Securing a home equity consolidation loan requires careful research and comparison of available options. This section will provide you with valuable resources to help you navigate this process.

Reputable Lenders and Financial Institutions

Finding the right lender is crucial for obtaining a home equity consolidation loan that meets your specific needs and financial circumstances. Several reputable lenders and financial institutions offer home equity consolidation loans. Here are some examples:- Banks: Major banks, such as Bank of America, Chase, Wells Fargo, and Citibank, typically offer home equity consolidation loans. These institutions often have extensive branch networks and online platforms, providing convenient access to their services.

- Credit Unions: Credit unions are member-owned financial institutions known for their competitive rates and personalized service. They may offer more favorable terms compared to traditional banks, especially for borrowers with good credit history.

- Online Lenders: Online lenders, such as LendingTree and SoFi, have gained popularity in recent years. They often streamline the application process and offer competitive rates, making them a convenient option for borrowers seeking a quick and efficient loan experience.

Information and Guidance Resources

Accessing reliable information is essential when considering a home equity consolidation loan. Several websites and resources provide comprehensive guidance on this type of loan:- Consumer Financial Protection Bureau (CFPB): The CFPB is a government agency dedicated to protecting consumers in the financial marketplace. Their website offers valuable resources, including information on home equity loans and their potential risks.

- National Endowment for Financial Education (NEFE): NEFE is a non-profit organization that provides financial education and counseling. Their website offers resources on various financial topics, including home equity loans and debt consolidation strategies.

- Financial Industry Regulatory Authority (FINRA): FINRA is a self-regulatory organization for the securities industry. Their website provides information on investment products, including home equity loans, and offers tools to help consumers compare different loan options.

Home Equity Consolidation Loan Product Features and Benefits

Different lenders offer various home equity consolidation loan products with unique features and benefits. Here is a table outlining key aspects of common product types:| Product Type | Key Features | Benefits |

|---|---|---|

| Fixed-Rate Loan | - Interest rate remains constant throughout the loan term. - Predictable monthly payments. | - Offers stability and protection against rising interest rates. - Allows for budgeting certainty. |

| Variable-Rate Loan | - Interest rate fluctuates based on market conditions. - Initial rate may be lower than fixed-rate loans. | - Potential for lower initial payments. - May benefit from declining interest rates. |

| Home Equity Line of Credit (HELOC) | - Provides a revolving line of credit secured by your home. - Allows for withdrawals as needed within a set credit limit. | - Offers flexibility and access to funds when needed. - Can be used for various purposes, including debt consolidation. |