Fixed home loans offer a unique path to homeownership, providing stability and predictability in a fluctuating financial landscape. With a fixed interest rate, borrowers can lock in their monthly payments for a set period, ensuring that their budget remains consistent even as market conditions change. This stability allows homeowners to plan for the future with confidence, knowing their mortgage payments will not be subject to unexpected increases.

This comprehensive guide delves into the intricacies of fixed home loans, exploring their benefits, features, and potential drawbacks. We will compare fixed loans to their variable counterparts, examining the advantages and disadvantages of each option. Ultimately, this guide aims to empower you with the knowledge you need to make informed decisions about your home financing journey.

What is a Fixed Home Loan?

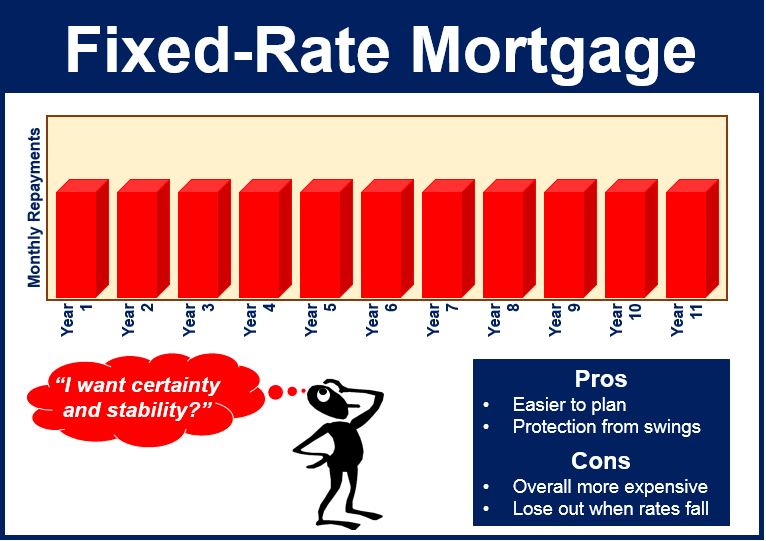

A fixed home loan is a type of mortgage where the interest rate remains the same for a predetermined period, typically ranging from one to thirty years. This means that your monthly repayments will be predictable and consistent throughout the fixed term, offering financial stability and peace of mind.How Fixed Interest Rates Work

Fixed interest rates are set by the lender at the time you take out the loan and remain unchanged for the duration of the fixed term. This contrasts with variable interest rates, which fluctuate based on market conditions.Benefits of a Fixed Home Loan

- Predictable Monthly Repayments: Fixed interest rates ensure consistent monthly repayments, making budgeting easier and allowing you to accurately plan your finances.

- Protection Against Interest Rate Rises: Fixed rates shield you from the risk of rising interest rates, safeguarding your budget from fluctuations in the market.

- Financial Stability: Knowing your monthly repayments will remain the same provides peace of mind and allows you to focus on other financial goals.

Scenarios Where a Fixed Home Loan is Advantageous

- Uncertainty in the Market: If you anticipate interest rates rising, a fixed home loan can provide protection against increased repayments.

- Budget-Conscious Individuals: Fixed rates offer predictable and consistent repayments, making budgeting easier and allowing for better financial planning.

- Long-Term Stability: For those seeking financial stability and predictable repayments over an extended period, a fixed home loan can be a suitable option.

Fixed vs. Variable Home Loans

Choosing the right type of home loan is a crucial decision for any homeowner. Understanding the differences between fixed and variable home loans can help you make an informed choice that aligns with your financial goals and risk tolerance.Key Differences Between Fixed and Variable Home Loans

Fixed and variable home loans differ primarily in their interest rates. Fixed-rate loans offer predictable monthly payments throughout the loan term, while variable-rate loans have interest rates that fluctuate based on market conditions.- Fixed-rate loans have a set interest rate that remains constant for the entire loan term, typically ranging from 15 to 30 years. This predictable rate provides stability in your monthly payments, making budgeting easier.

- Variable-rate loans have an interest rate that is tied to a benchmark rate, such as the prime rate or the London Interbank Offered Rate (LIBOR). This benchmark rate fluctuates, and your loan interest rate will adjust accordingly. This means your monthly payments could go up or down as the benchmark rate changes.

Advantages and Disadvantages of Fixed Home Loans

- Advantages:

- Predictable monthly payments: Fixed-rate loans offer stability and predictability, making budgeting easier and allowing you to plan for future expenses with confidence.

- Protection against rising interest rates: If interest rates rise, your monthly payments will remain the same, providing protection against potential financial strain.

- Peace of mind: Knowing your monthly payments will stay the same for the duration of the loan can provide peace of mind and reduce financial stress.

- Disadvantages:

- Higher initial interest rates: Fixed-rate loans often have higher initial interest rates compared to variable-rate loans, as lenders need to compensate for the risk of locking in a specific rate for the loan term.

- Inability to benefit from falling interest rates: If interest rates fall, you won't be able to take advantage of lower rates with a fixed-rate loan.

Advantages and Disadvantages of Variable Home Loans

- Advantages:

- Lower initial interest rates: Variable-rate loans typically have lower initial interest rates than fixed-rate loans, as lenders can adjust the rate based on market conditions.

- Potential for lower monthly payments: If interest rates fall, your monthly payments could decrease, potentially saving you money over the loan term.

- Disadvantages:

- Unpredictable monthly payments: Variable-rate loans offer less predictability, as your monthly payments can fluctuate based on changes in the benchmark rate. This can make budgeting more challenging.

- Risk of rising interest rates: If interest rates rise, your monthly payments could increase significantly, potentially putting a strain on your budget.

- Limited flexibility: Variable-rate loans may offer limited flexibility in terms of making extra payments or changing the loan term.

Scenarios Where Each Loan Type Might Be Preferable

- Fixed-rate loans may be preferable for borrowers who:

- Value predictability and stability: Borrowers who prioritize knowing exactly how much their monthly payments will be for the entire loan term might prefer a fixed-rate loan.

- Are concerned about rising interest rates: If you're worried about interest rates increasing in the future, a fixed-rate loan can protect you from higher payments.

- Have a long-term financial plan: Fixed-rate loans provide stability and predictability, which can be beneficial if you have a long-term financial plan in place.

- Variable-rate loans may be preferable for borrowers who:

- Are comfortable with some risk: Variable-rate loans offer the potential for lower interest rates, but they also come with the risk of higher payments if interest rates rise.

- Plan to pay off their loan quickly: If you plan to pay off your loan within a shorter timeframe, the potential for lower initial interest rates with a variable-rate loan could be advantageous.

- Believe interest rates will fall: If you believe interest rates will fall in the future, a variable-rate loan could allow you to benefit from lower payments.

Key Differences Between Fixed and Variable Home Loans

| Feature | Fixed-Rate Loan | Variable-Rate Loan |

|---|---|---|

| Interest Rate | Set for the entire loan term | Fluctuates based on a benchmark rate |

| Monthly Payments | Predictable and stable | Can fluctuate based on interest rate changes |

| Risk | Lower risk of higher payments, but higher initial interest rate | Higher risk of higher payments, but potentially lower initial interest rate |

| Suitability | Ideal for borrowers seeking predictability and protection against rising interest rates | Suitable for borrowers comfortable with some risk and who believe interest rates will fall |

Factors to Consider When Choosing a Fixed Home Loan

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg) Choosing the right fixed home loan is a significant decision that can impact your finances for years to come. It's essential to carefully consider various factors to ensure you secure a loan that aligns with your financial goals and circumstances.

Choosing the right fixed home loan is a significant decision that can impact your finances for years to come. It's essential to carefully consider various factors to ensure you secure a loan that aligns with your financial goals and circumstances.

Evaluating Your Financial Situation

Understanding your financial standing is crucial before applying for a fixed home loan. This involves assessing your income, expenses, and overall financial health. A thorough analysis of your financial situation helps determine how much you can comfortably afford to borrow, allowing you to select a loan amount that fits within your budget. It also provides clarity on your repayment capacity, ensuring you can meet your monthly mortgage obligations without straining your finances.The Importance of Your Credit Score and Loan History

Your credit score plays a vital role in securing a favorable fixed home loan interest rate. Lenders use credit scores to assess your creditworthiness, considering factors such as your payment history, outstanding debt, and credit utilization. A higher credit score generally translates to better interest rates and loan terms. Similarly, your loan history, including previous mortgages or loans, provides lenders with insight into your borrowing and repayment behavior. A positive loan history demonstrates your reliability and financial responsibility, increasing your chances of securing a competitive loan offer.Researching and Comparing Loan Options

Once you have a clear understanding of your financial situation, it's time to research and compare different fixed home loan options available in the market. This involves gathering information from various lenders, including banks, credit unions, and mortgage brokers. It's crucial to compare interest rates, loan terms, fees, and other associated costs to find the most favorable offer.- Interest Rates: Interest rates are a key factor to consider when comparing fixed home loans. A lower interest rate translates to lower monthly payments and less interest paid over the life of the loan. It's essential to compare interest rates from multiple lenders to ensure you're getting the best possible deal.

- Loan Terms: Loan terms refer to the duration of the loan, typically expressed in years. Shorter loan terms generally result in higher monthly payments but lower overall interest costs. Conversely, longer loan terms lead to lower monthly payments but higher overall interest costs. Choosing the right loan term depends on your individual financial circumstances and goals.

- Fees: Lenders may charge various fees associated with fixed home loans, such as application fees, origination fees, and appraisal fees. These fees can vary significantly between lenders, so it's essential to compare them carefully. Be sure to factor in all fees when calculating the total cost of the loan.

- Other Considerations: When comparing fixed home loans, consider other factors such as prepayment penalties, early repayment options, and lender reputation. Some lenders may offer prepayment penalties, which can limit your ability to pay down your mortgage early. Others may provide early repayment options, allowing you to make additional payments to reduce your principal balance and interest costs. It's essential to choose a lender with a strong reputation for customer service and financial stability.

Calculating the Total Cost of a Fixed Home Loan

To make an informed decision, it's essential to calculate the total cost of a fixed home loan. This includes not only the principal amount borrowed but also the interest accrued over the loan term.Total Loan Cost = Principal Amount + Total Interest PaidYou can use online mortgage calculators or consult with a financial advisor to estimate the total cost of different loan options. This will provide you with a comprehensive understanding of the financial implications of each loan and help you make a decision that aligns with your budget and financial goals.

Finding the Right Fixed Home Loan

Finding the right fixed home loan involves careful research, comparison, and negotiation. This process ensures you secure a loan that aligns with your financial needs and goals.Essential Questions to Ask Lenders

When evaluating fixed home loan options, it is crucial to understand the loan's terms and conditions thoroughly. Asking lenders the right questions can help you make an informed decision.- Loan Interest Rate: Inquire about the current fixed interest rate and whether it is fixed for the entire loan term or only for a specific period.

- Loan Term: Determine the available loan terms and their impact on monthly payments and overall interest costs. A longer loan term typically results in lower monthly payments but higher overall interest costs.

- Loan Fees: Clarify the associated fees, such as application fees, establishment fees, and ongoing monthly fees. These fees can significantly impact the total cost of the loan.

- Loan Repayment Options: Explore available repayment options, such as principal and interest payments, interest-only payments, or accelerated repayments.

- Loan Features: Understand the loan's features, such as offset accounts, redraw facilities, and the possibility of making extra repayments. These features can enhance your borrowing flexibility.

- Loan Eligibility Criteria: Confirm the lender's eligibility criteria, including income requirements, credit history, and debt-to-income ratio.

- Loan Approval Process: Inquire about the loan approval process, including the required documentation, processing time, and any potential delays.

Negotiating Loan Terms and Conditions

Negotiating loan terms and conditions can potentially save you money and improve your borrowing experience.- Interest Rate: While fixed interest rates are typically less negotiable than variable rates, you can still try to negotiate a lower rate, especially if you have a strong credit history and a substantial deposit.

- Fees: Negotiate lower or waived fees, such as application fees, establishment fees, or ongoing monthly fees.

- Loan Features: Explore the possibility of securing additional loan features, such as offset accounts or redraw facilities, to enhance your borrowing flexibility.

- Loan Term: Negotiate a longer loan term if you want lower monthly payments, but remember that this will increase the overall interest costs.

- Early Repayment Penalties: If possible, negotiate a waiver or reduction of early repayment penalties, as these can be costly if you need to repay the loan early.

Comparing Different Loan Offers, Fixed home loan

Comparing different loan offers is crucial to ensure you choose the best option for your needs.- Interest Rate: Compare the interest rates of different lenders and consider the overall cost of the loan, including any associated fees.

- Loan Features: Evaluate the features of different loan offers and prioritize those that align with your financial needs and goals.

- Loan Terms: Compare the loan terms, including the loan term, repayment options, and any applicable penalties.

- Lender Reputation: Research the reputation of different lenders and consider their customer service, financial stability, and any complaints or issues.

Securing Pre-Approval for a Fixed Home Loan

Securing pre-approval for a fixed home loan can give you an advantage in the property market.- Benefits of Pre-Approval: Pre-approval demonstrates to sellers that you are a serious buyer with the financial capacity to purchase a property. It also provides you with a clear understanding of your borrowing capacity, allowing you to focus your property search on properties within your budget.

- Process for Obtaining Pre-Approval: To obtain pre-approval, you will typically need to provide the lender with information about your income, expenses, and assets. The lender will then assess your financial situation and provide you with a pre-approval letter outlining the loan amount they are willing to lend you.

- Impact of Pre-Approval: Pre-approval is not a guarantee of loan approval, but it can increase your chances of securing a loan and expedite the home buying process.

Understanding the Risks and Rewards of Fixed Home Loans

Choosing a fixed home loan involves understanding the potential risks and rewards associated with this type of mortgage. While fixed rates offer stability and predictability, they also come with certain limitations. It's crucial to weigh these factors carefully before making a decision.

Choosing a fixed home loan involves understanding the potential risks and rewards associated with this type of mortgage. While fixed rates offer stability and predictability, they also come with certain limitations. It's crucial to weigh these factors carefully before making a decision.

Potential Risks of Fixed Home Loans

The decision to opt for a fixed home loan comes with potential risks that need careful consideration. These risks can influence your long-term financial planning and should be thoroughly analyzed before making a commitment.- Higher Interest Rates: Fixed rates are generally higher than variable rates, especially during periods of low interest rates. This can result in paying more interest over the life of the loan, leading to a higher overall cost.

- Missed Opportunity for Lower Rates: If interest rates fall significantly after you lock in a fixed rate, you may miss out on the opportunity to refinance at a lower rate and reduce your monthly payments. This can be a substantial financial loss, especially for longer-term loans.

- Limited Flexibility: Fixed-rate mortgages offer limited flexibility in terms of making extra payments or adjusting your loan term. This can be a disadvantage if your financial situation changes unexpectedly, such as a job loss or unexpected expenses.

Potential Rewards of Fixed Home Loans

Despite the risks, fixed home loans offer several benefits that can be attractive to borrowers seeking stability and predictability in their mortgage payments. These rewards can significantly impact your financial planning and overall homeownership experience.- Predictable Monthly Payments: Fixed-rate mortgages provide certainty about your monthly payments for the entire loan term. This allows you to budget effectively and avoid surprises related to fluctuating interest rates.

- Protection Against Rising Interest Rates: In a rising interest rate environment, fixed-rate mortgages offer protection against increasing borrowing costs. Your monthly payments remain constant, shielding you from the impact of rate fluctuations.

- Peace of Mind: Knowing your mortgage payments will remain consistent can provide peace of mind and allow you to focus on other financial goals. This predictability can be especially valuable for long-term financial planning.

Seeking Professional Financial Advice

Navigating the complexities of fixed home loans can be challenging. It's highly recommended to consult with a qualified financial advisor to understand the risks and rewards specific to your situation. A financial advisor can provide personalized guidance based on your financial goals, risk tolerance, and current market conditions."Seeking professional financial advice is crucial when making significant financial decisions, such as choosing a fixed home loan. An advisor can provide unbiased guidance and help you make informed choices based on your individual circumstances."

Summary of Risks and Rewards

| Aspect | Risks | Rewards |

|---|---|---|

| Interest Rates | Higher initial interest rates compared to variable rates | Protection against rising interest rates |

| Flexibility | Limited flexibility in making extra payments or adjusting loan terms | Predictable monthly payments for the entire loan term |

| Opportunity Cost | Missed opportunity for lower rates if interest rates decline | Peace of mind and stability in mortgage payments |